1st 9 month Canadian Exchange IPOs: 11 IPOs, $426M

Canadian initial public offering (IPO) continues its listless activities in Q3 2025, recording three IPOs for gross proceeds of $411.2 million, with one each on the Canadian Securities Exchange (CSE), The TSX Venture Exchange (TSX-V), and the Toronto Stock Exchange (TSX).

GO Residential Real Estate Investment Trust (TSX: GO.U) raised $410.1 million, representing 99.7% of the total gross amount raised in Q3 2025 or 96.3% of total gross amount raised in the first nine months of 2025.

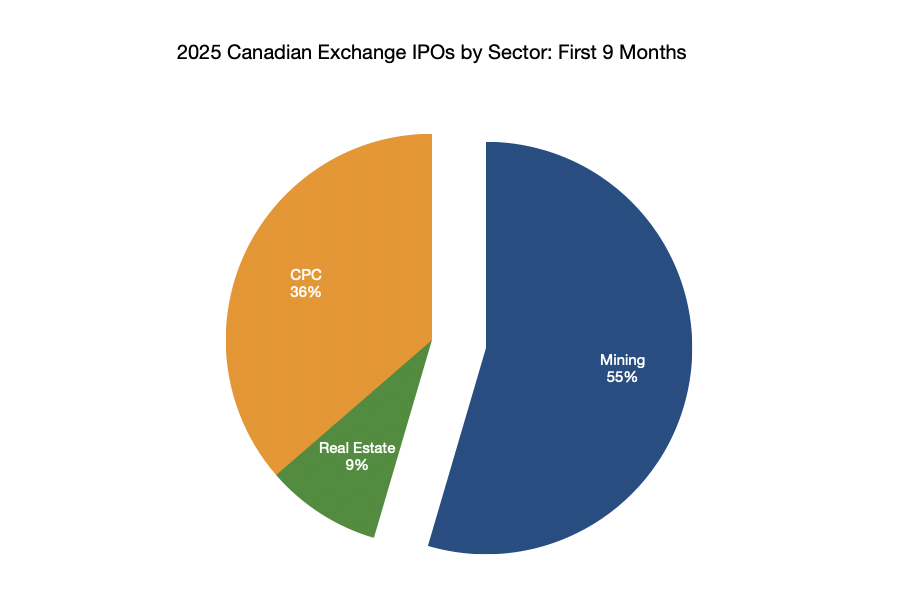

For the first nine months, 11 IPOs completed on three Canadian exchanges raising $426 million in gross proceeds. Excluding Capital Pool Company (CPC) IPOs, 7 IPOs completed for $424.3 million.

There was no IPO on NEO/CBOE Canada in 2025.

Almost all mining IPOs

For the first nine months, 6 mining IPOs completed, accounting 55% of all IPOs or 86% of all IPOs excluding CPC IPOs.

Q4 2025 and Outlook

One CPC IPO completed on the TSX-V in October.

The pending IPO by Brookfield backed Rockpoint Gas Storage Inc., if completed in 2025, would represent first private equity (PE)-backed IPO in two years, the 2nd since 2023, or the 3rd since 2022.

Venture capital-backed IPOs have altogether disappeared since 2022 and have yet to show any sign of recovering.

Source: CPE Analytics/Canadian Financings

Credit: Source link