Stock Futures Quietly Higher Amid U.S.-China Talks Over TikTok

The major benchmarks are fresh off record closes

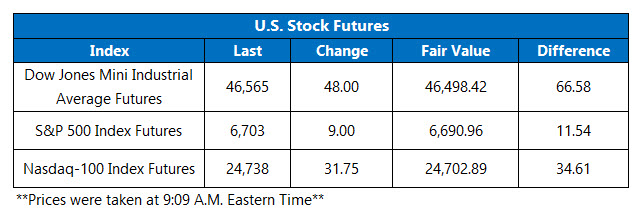

After all three major indexes yesterday notched record closes, futures on the Dow Jones Industrial Average (DJIA), Nasdaq-100 Index (NDX), and S&P 500 Index (SPX) are modestly higher this morning. Investors are now monitoring a call between Chinese President Xi Jinping and President Donald Trump over TikTok operations in the U.S., as well as the U.S. Securities and Exchange Commission’s (SEC) move to propose a rule that would shift earnings reports from a quarterly to semiannual basis.

Continue reading for more on today’s market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw over 3.7 million call contracts and more than 2 million put contracts exchanged on Thursday. The single-session equity put/call ratio fell to 0.54, while the 21-day moving average remained at 0.59.

- Citigroup downgraded Intel Corp (NASDAQ:INTC) stock to “sell” from “neutral,” citing valuation concerns. The equity surged yesterday on the heels of a $5 billion investment from sector peer Nvidia (NVDA) and now sports a 52.5% year-to-date lead, but is down 0.9% in premarket trading.

- Lennar Corp (NYSE:LEN) stock is down 3.7% before the open, after the company issued a dismal fiscal fourth-quarter forecast for home orders, in addition to a third-quarter revenue miss. The homebuilder noted job market instability and higher prices due to inflation. LEN already carries a 26.6% year-over-year deficit.

- FedEx Corp (NYSE:FDX) stock is up 1.4% ahead of the bell, after the company posted better-than-expected results for the fiscal first quarter. So far in 2025, the equity has shed 19.5%.

- Next week brings housing data and a gross domestic product (GDP) update.

European, Asian Markets Move Lower

Despite strong movement throughout the week, Asian markets ended on a weak note. The big story was out of Japan, where the Nikkei slipped 0.6% despite hitting another record high earlier in the session. The Bank of Japan kept its policy rate unchanged and unveiled plans to sell its ETFs, a decision made after three-straight months of declining core inflation rates. Japan bond yields spiked in response. South Korea’s Kospi wasn’t far behind, losing 0.5%. China’s Shanghai Composite dipped 0.3%, while Hong Kong’s Hang Seng was flat.

European markets are also struggling. France’s CAC 40 was the region’s lone winner, up 0.2%, as budget-cut strikes begin to ease and investors await business conference updates. London’s FTSE 100 was flat ahead of retail sales data and following a rise in government borrowing costs. Germany’s DAX is edging 0.2% lower, despite auto parts maker Continental skyrocketing more than 30%, as traders look forward to upcoming PPI data.

Credit: Source link