Bond Markets End Q3 on a High Note

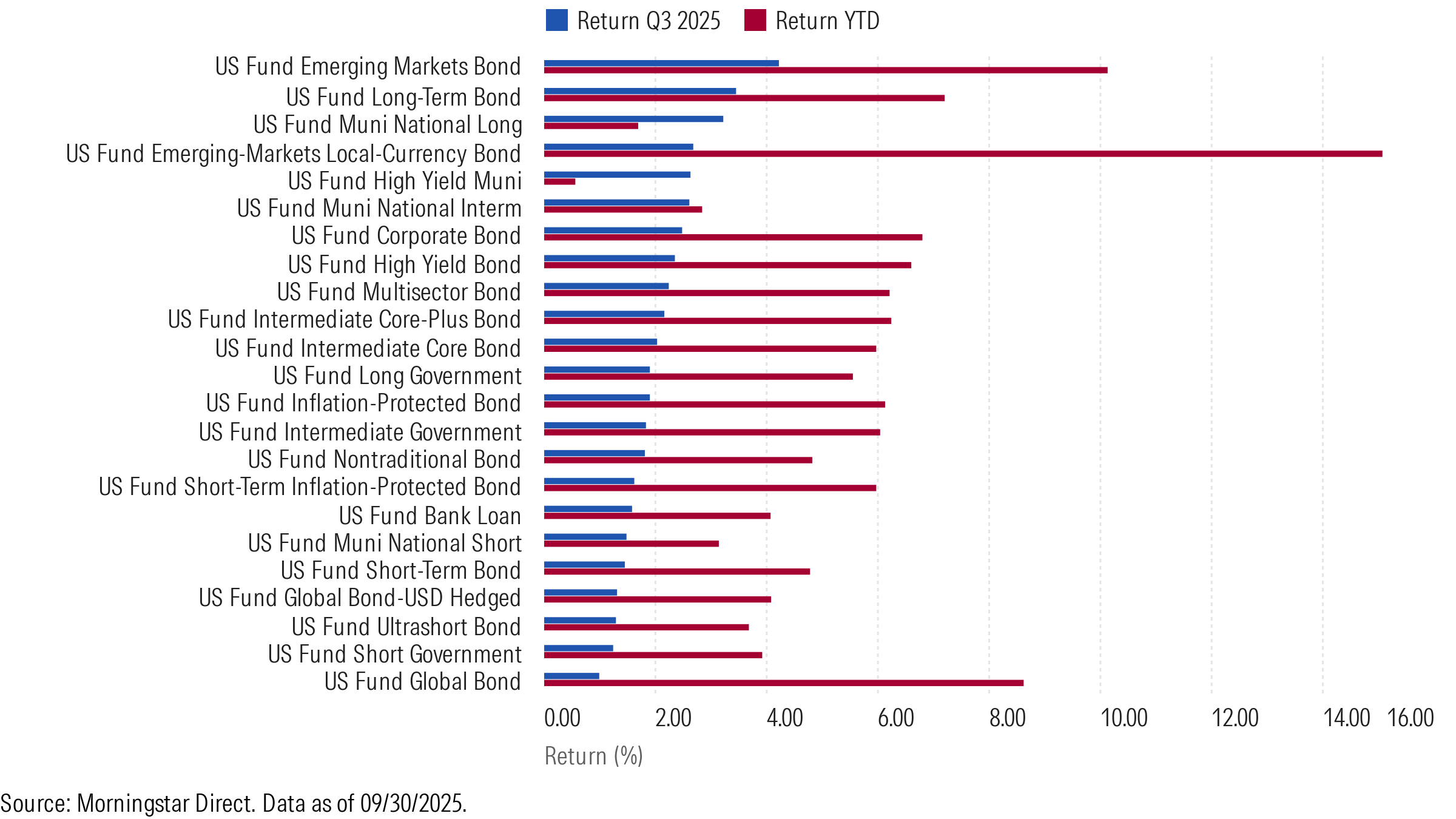

At the close of 2025’s third quarter, all major fixed-income Morningstar Categories showcased positive returns, but it wasn’t a smooth-sailing ride.

In July, the 10-Year Treasury yield hovered between cycle highs of 4.35% and 4.45%, and credit spreads widened due to higher-than-expected inflation numbers and political uncertainty. However, as the quarter progressed, the market sentiment shifted from caution to renewed optimism. Treasury yields decreased across the curve, and in September, the Federal Reserve reduced its overnight borrowing rate for banks by 25 basis points, reinforcing expectations for further policy support. While yields fell, the Treasury yield curve steepened during the quarter, with short-term yields falling more than long-term rates, signaling investor caution about the long-term economic outlook. Meanwhile, credit-sensitive sectors staged a rebound, and almost all fixed-income sectors promptly gained back their July losses. The Morningstar US Core Bond Index, a proxy for the US-dollar-denominated investment-grade bond market, gained 2.04% during the quarter.

In what turned out to be a volatile quarter, investors who took reasonable duration and credit risk were rewarded in the end. A typical long-term bond Morningstar Category fund, which invests in long-dated investment-grade corporate and government debt and carries a duration of 11.2 years, gained 3.66% during the quarter.

On the other hand, investors who ventured outside the US markets continued their winning streak. The Morningstar Emerging Markets Sovereign Bond Index, which measures performance of US-dollar-denominated sovereign bonds issued by emerging-market countries, gained 4.93% over the quarter, while Morningstar US 10+ Year Treasury Bond Index gained 2.64%.

Below, we dig into a few fixed-income categories and highlight how some of our favorite bond managers fared during the quarter.

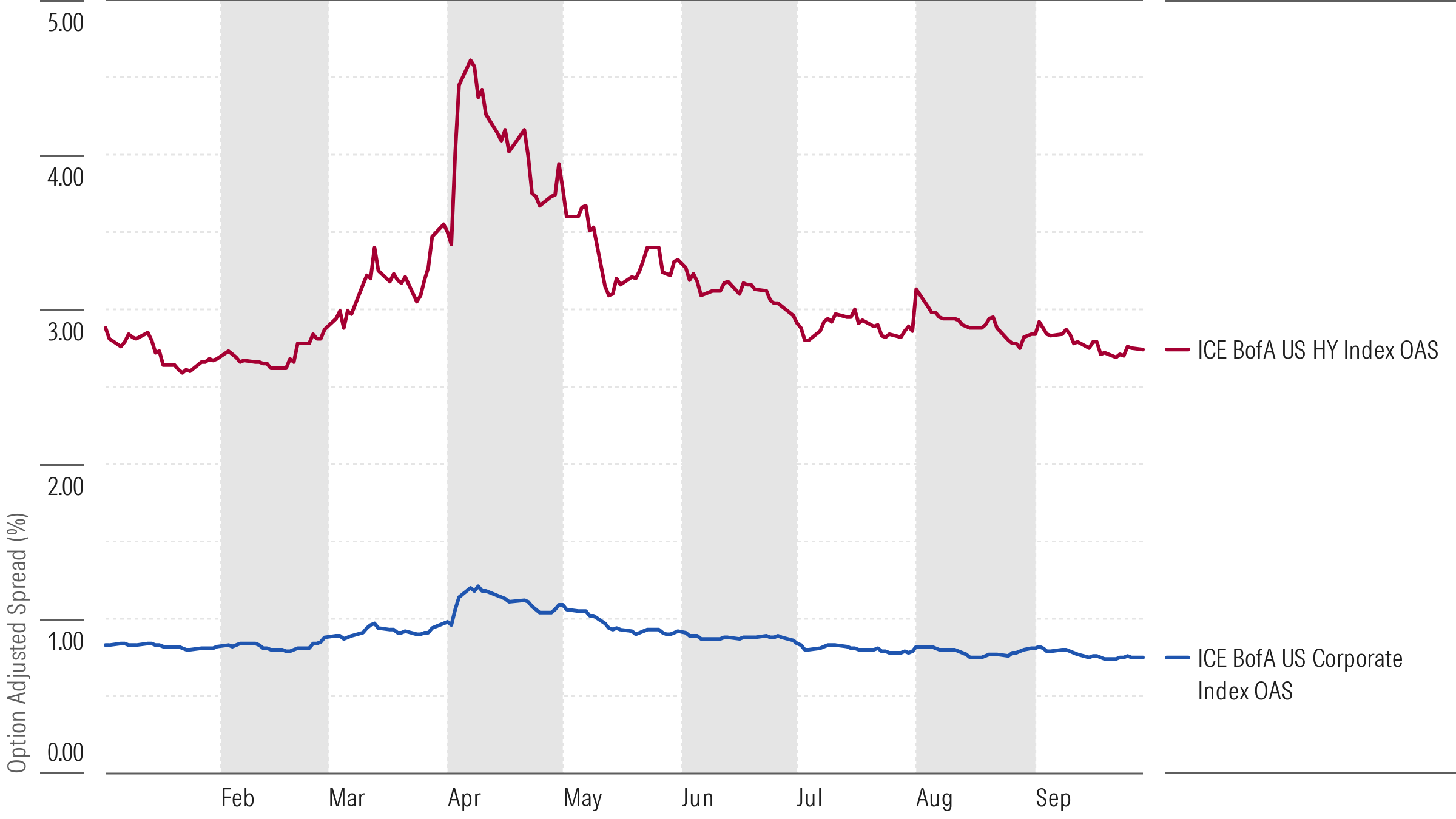

Credit Outshines

As credit spreads tightened after a marginal widening earlier in the quarter, both high-yield and investment-grade bonds delivered positive returns. Investment-grade bonds had an advantage over their high-yield counterparts, as their relatively longer duration provided a tailwind for rising bond prices as yields fell. The Morningstar US Corporate Bond Index, a proxy for investment-grade US-dollar-denominated corporate bonds, returned 2.64% during the quarter, while the Morningstar US High-Yield Bond Index gained 2.44%.

Invesco Corporate Bond ACCHX, which has a Morningstar Medalist Rating of Bronze and is one of the most aggressive funds within the corporate bond Morningstar Category, gained 2.94% during the quarter and landed among the category’s top 10%. Bronze-rated Federated Hermes Corporate Bond FDBIX, which took a more defensive stance in early 2025 and reduced its high-yield debt exposure in the portfolio, gained just 2.32% and lagged more than half its distinct peers.

Munis Come Roaring Back

After a disappointing first half of the year and a weak start to this quarter, municipal bonds outperformed most fixed-income sectors, including intermediate term US Treasuries. The Morningstar US Municipal Bond Index gained 3.14% during the quarter, while the Morningstar US Treasury Bond Index gained only 1.52%. This outperformance came on the heels of the Federal Reserve’s interest rate cut in September, which supported increased municipal-bond prices. The municipal-bond market also saw a resurgence of demand driven by attractive yields and more clarity around their tax-exempt status.

Gold-rated Vanguard Long-Term Tax-Exempt Bond VWLUX gained 3.46% during the quarter ahead of most of its peers, thanks to its slightly longer duration than the peer median, which added to returns as yields fell. Bronze-rated NYLI MacKay Tax Free Bond MTBIX also gained 3.21% over the period but landed in the category’s second quartile owing to its relatively shorter duration within the category.

Emerging-Market Debt Led the Way

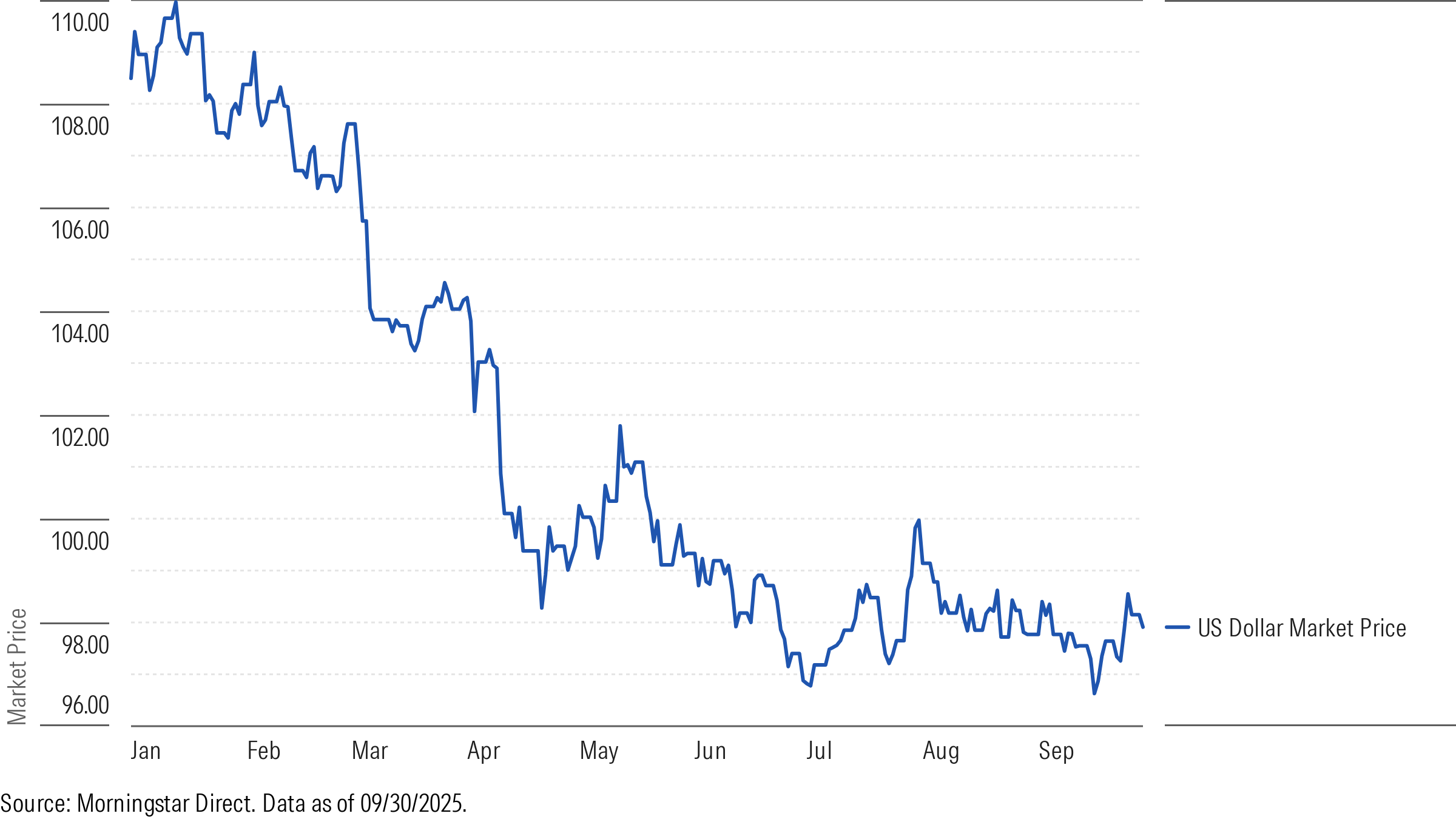

Emerging-market debt outperformed all fixed-income sectors given a stable global economic backdrop and a dovish shift by the Federal Reserve increasing the asset class’ attractiveness. The typical fund in the emerging-market bond category, a group of strategies that invest more than 65% of assets in foreign bonds from developing countries, gained 4.27% during the quarter, while its emerging-market local-currency bond counterpart, which takes more foreign-currency risk, gained 2.57%. While emerging-market local-currency bond funds faced headwinds in July 2025 when the US dollar strengthened for a brief period, the category’s 15.07% return for the year to date through September 2025 surpassed all fixed-income sectors thanks primarily to a weakening US dollar amid trade policy uncertainty and economic cooling.

Bronze-rated Pimco Emerging Market Bond PEBIX gained 4.98% during the quarter, while its unhedged counterpart Pimco Emerging Markets Local Currency Bond PELBX gained 3.49%. That said, the latter’s foreign-currency exposure has led to its 17.95% gain for the year to date through September 2025, which is well ahead of its hedged sibling fund’s 11.49%.

Credit: Source link