Spike in Refis, Triggered by Small Dip in Mortgage Rates, Fizzled. Demand for Mortgages to Purchase Homes Still in Deepfreeze

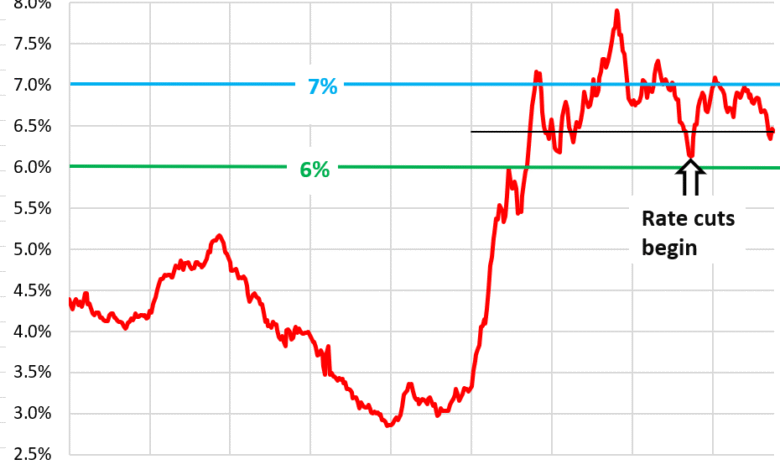

Mortgage rates are still higher than before the rate cuts started over a year ago.

By Wolf Richter for WOLF STREET.

The average weekly mortgage rate for conforming 30-year fixed mortgages edged down to 6.43%, according to the Mortgage Bankers Association today. But that was still higher than two weeks ago and three weeks ago, and quite a bit higher than in September and early October 2024 when it bottomed out at 6.13% just before the Fed started cutting interest rates.

Demand for mortgages to purchase a home, with home prices still way too high, remained abysmally low.

And the September spike in applications to refinance existing mortgages on this minuscule September dip in mortgage rates has unwound.

From mid-September 2024 through early January 2025, mortgage rates jumped by 100 basis points, as the Fed cut its policy rates by 100 basis points despite reaccelerating inflation. A lot of hawkish talk from the Fed since then calmed down the bond market’s inflation fears, and the mortgage market is geared on the bond market, specifically the 10-year Treasury yield, and not the Fed’s short-term policy rates. The somewhat calmer bond market has helped mortgage rates come down.

Aggressive rate cuts by the Fed this fall, as inflation has been re-accelerating, could cause those mortgage rates to jump back up as they had done last year at this time.

The spike in refis that didn’t last. There had been a sudden spike in applications for mortgages to refinance existing mortgages starting in mid-September when mortgage rates dipped just a hair. That spike lasted for two weeks. And when rates inched up again a hair, that spike in demand for refi mortgages settled back down.

The prior spike in demand for refi mortgages occurred a year ago in September 2024, when the MBA’s measure of the average weekly 30-year fixed mortgage rate dropped as low as 6.13%.

Any little dip in mortgage rates brings out new waves of homeowners that pounce to try to refinance a mortgage and cause refi mortgage applications to spike. And when rates rise just a little, that demand fizzles.

Despite those mortgage rates in the 6-7% range, homeowners still want to refinance mortgages for various reasons, and so some refinancings are still happening.

There are up-front fees to be paid by homeowners when they refinance a mortgage – typically 1% of the mortgage balance – and those fees are then added to the loan amount and increase the payment, which reduces the advantage of lower mortgage rates. So homeowners who want to refi a mortgage to lower their payment do a breakeven analysis with online calculators or through brokers or mortgage lenders, to see if it’s even worth it. And when that calculus tilts in their way, they might pounce, creating these brief spikes in refis.

Other homeowners have different reasons to refi, and the points are secondary. Mortgages also count as refinance mortgages when homeowners that no longer have a mortgage do a cash-out mortgage on the home they own (this could be cheaper than a HELOC).

But demand for refi mortgages, even at the top of that spike in September, was still relatively low compared to the years when much lower mortgage rates prevailed.

This is the decade-long view of mortgage rates (blue) and refinance mortgage applications. It shows the inverse relationship between mortgage rates and refi applications:

Mortgage applications to purchase a home dipped for the second week in a row and has been essentially unchanged for five weeks. While up from rock-bottom, they remained at dismally low levels, down by 32% from the same week in 2019.

Purchase mortgage applications are a measure of demand for homes that may become actual home sales in the future and are therefore a forward-looking indicator of home sales.

And these low levels of purchase mortgage applications are another sign, among many others, that going forward, demand for homes remains historically low after the price explosion between early 2020 and mid-2022.

In case you missed it: The “Lock-in Effect” and Mortgage Rates: Update on Unwinding a Phenomenon that Wrecked the Housing Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

WOLF STREET FEATURE: Daily Market Insights by Chris Vermeulen, Chief Investment Officer, TheTechnicalTraders.com.

Credit: Source link