TSX Penny Stocks With Market Caps Larger Than CA$20M

As the U.S. government shutdown unfolds, its immediate impact on Canadian markets remains limited, with resilient consumer spending and record AI investments helping to maintain economic momentum. In the context of these broader market dynamics, penny stocks—though often considered a niche investment area—continue to present intriguing opportunities for growth, especially when backed by strong financial health. Despite their somewhat outdated label, these smaller or newer companies can offer unique value propositions and potential upside for investors willing to explore beyond traditional large-cap stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.67 | CA$69.27M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.395 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$53.32M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.335 | CA$931.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.10 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.89 | CA$484.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.51 | CA$172.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.20 | CA$209.8M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lycos Energy Inc. is a resource company focused on the development and production of petroleum and natural gas in Western Canada, with a market cap of CA$71.34 million.

Operations: The company’s revenue is primarily derived from its Oil & Gas – Exploration & Production segment, which generated CA$115.06 million.

Market Cap: CA$71.34M

Lycos Energy, with a market cap of CA$71.34 million, has faced challenges with increasing debt levels and declining earnings. Despite being unprofitable with a negative return on equity of -45.58%, the company has resumed drilling operations in Western Canada, planning to invest CA$10 million in its exploration program for 2025’s second half. Short-term assets are insufficient to cover short-term liabilities, but operating cash flow adequately covers debt obligations. Recent revenue decline and net losses highlight financial pressures; however, the company’s strategic focus on disciplined growth could potentially enhance shareholder value amid volatile commodity prices.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tinka Resources Limited is a junior mineral exploration company focused on acquiring and exploring base and precious metals mineral properties in Peru, with a market cap of CA$35.97 million.

Operations: Tinka Resources Limited does not report any revenue segments, reflecting its focus on mineral exploration activities in Peru.

Market Cap: CA$35.97M

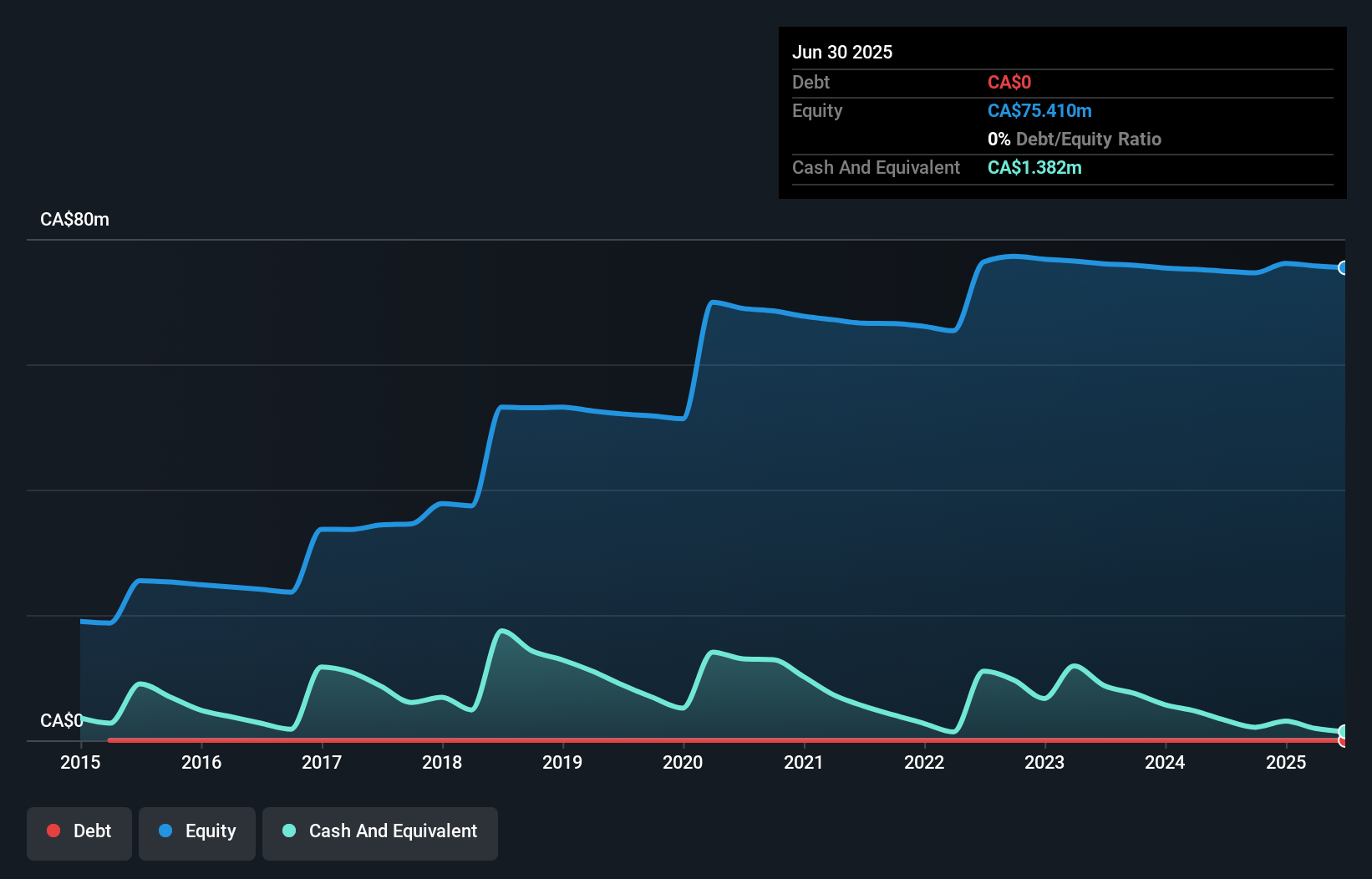

Tinka Resources, with a market cap of CA$35.97 million, is a pre-revenue company focused on mineral exploration in Peru. The recent strategic capital raise of approximately CA$14.28 million through private placements bolsters its short-term liquidity, extending its cash runway beyond the previous 5-month estimate. Despite being unprofitable, Tinka has reduced losses by 23.5% annually over the past five years and remains debt-free with strong asset coverage for liabilities. The company’s recent board reorganization and approval to initiate drilling at the Silvia gold-copper property could catalyze future growth prospects within Peru’s prolific mining regions.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TNR Gold Corp. focuses on the acquisition and exploration of mineral properties in the United States, with a market cap of CA$26.92 million.

Operations: TNR Gold Corp. does not report any revenue segments as it primarily concentrates on acquiring and exploring mineral properties in the United States.

Market Cap: CA$26.92M

TNR Gold Corp., with a market cap of CA$26.92 million, is a pre-revenue entity focused on mineral property exploration in the U.S. Despite its unprofitability, TNR has reduced losses by 23.9% annually over five years and maintains no debt, benefiting from strong asset coverage for short-term liabilities. The board and management are experienced, averaging tenures of 6.2 and 8.1 years respectively. However, TNR faces challenges with less than a year of cash runway if free cash flow continues to decline at historical rates, coupled with significant insider selling in recent months impacting investor sentiment.

Key Takeaways

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tinka Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com