3 Global Stocks Estimated To Be Trading At Discounts Of Up To 38.9%

In a week marked by volatility, global markets showed resilience as U.S. stocks rebounded and dovish signals from the Federal Reserve provided some support, despite ongoing concerns about trade tensions and credit market risks. As investors navigate these uncertain conditions, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on discrepancies between current stock prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Yangtze Optical Fibre And Cable Limited (SEHK:6869) | HK$36.72 | HK$72.80 | 49.6% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.72 | CN¥88.84 | 49.7% |

| Lotes (TWSE:3533) | NT$1425.00 | NT$2842.59 | 49.9% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.13 | 49.7% |

| Kitron (OB:KIT) | NOK61.15 | NOK121.16 | 49.5% |

| HD Hyundai Construction Equipment (KOSE:A267270) | ₩100000.00 | ₩198297.32 | 49.6% |

| ArcticZymes Technologies (OB:AZT) | NOK30.00 | NOK59.59 | 49.7% |

| Allegro.eu (WSE:ALE) | PLN33.74 | PLN66.43 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK85.20 | NOK169.70 | 49.8% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.19 | CN¥54.03 | 49.7% |

Let’s uncover some gems from our specialized screener.

Overview: Saudi Basic Industries Corporation manufactures, markets, and distributes chemicals, polymers, plastics, and agri-nutrients worldwide with a market cap of SAR185.70 billion.

Operations: The company’s revenue is primarily derived from Petrochemicals & Specialties, contributing SAR129.64 billion, and Agri-Nutrients, which account for SAR12.09 billion.

Estimated Discount To Fair Value: 21.7%

Saudi Basic Industries Corporation is trading at 21.7% below its estimated fair value of SAR 77.96, with a current price of SAR 61.05, indicating it might be undervalued based on cash flows. Despite reporting a net loss for the recent quarter and six months ending June 2025, earnings are forecast to grow significantly by over 90% annually, suggesting potential recovery. However, the dividend yield of 5.24% is not well covered by earnings or free cash flows.

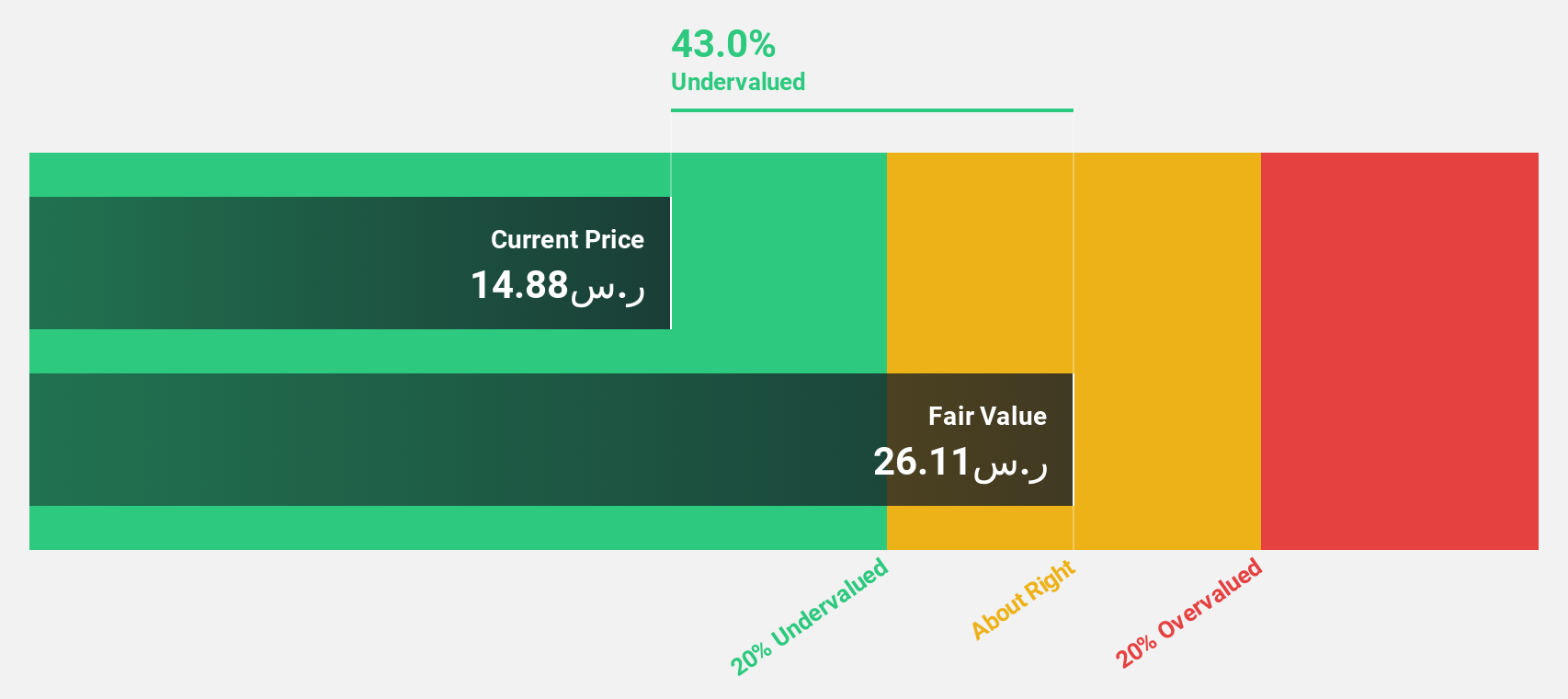

Overview: Saudi Electricity Company, along with its subsidiaries, is involved in the generation, transmission, and distribution of electricity across Saudi Arabia and has a market cap of SAR65.46 billion.

Operations: The company’s revenue segments include SAR28.94 billion from the National Grid Company, SAR17.81 billion from Generation, and SAR90.06 billion from Distribution and Subscribers Services.

Estimated Discount To Fair Value: 26%

Saudi Electricity is trading at SAR 15.65, significantly below its estimated fair value of SAR 21.14, highlighting potential undervaluation based on cash flows. Despite high debt levels, recent financing for the Qurayyah project enhances capacity and future revenue streams. Earnings are forecast to grow substantially by over 36% annually, although the dividend yield of 4.47% isn’t well covered by earnings or free cash flows. The new CEO appointment may drive strategic growth initiatives forward.

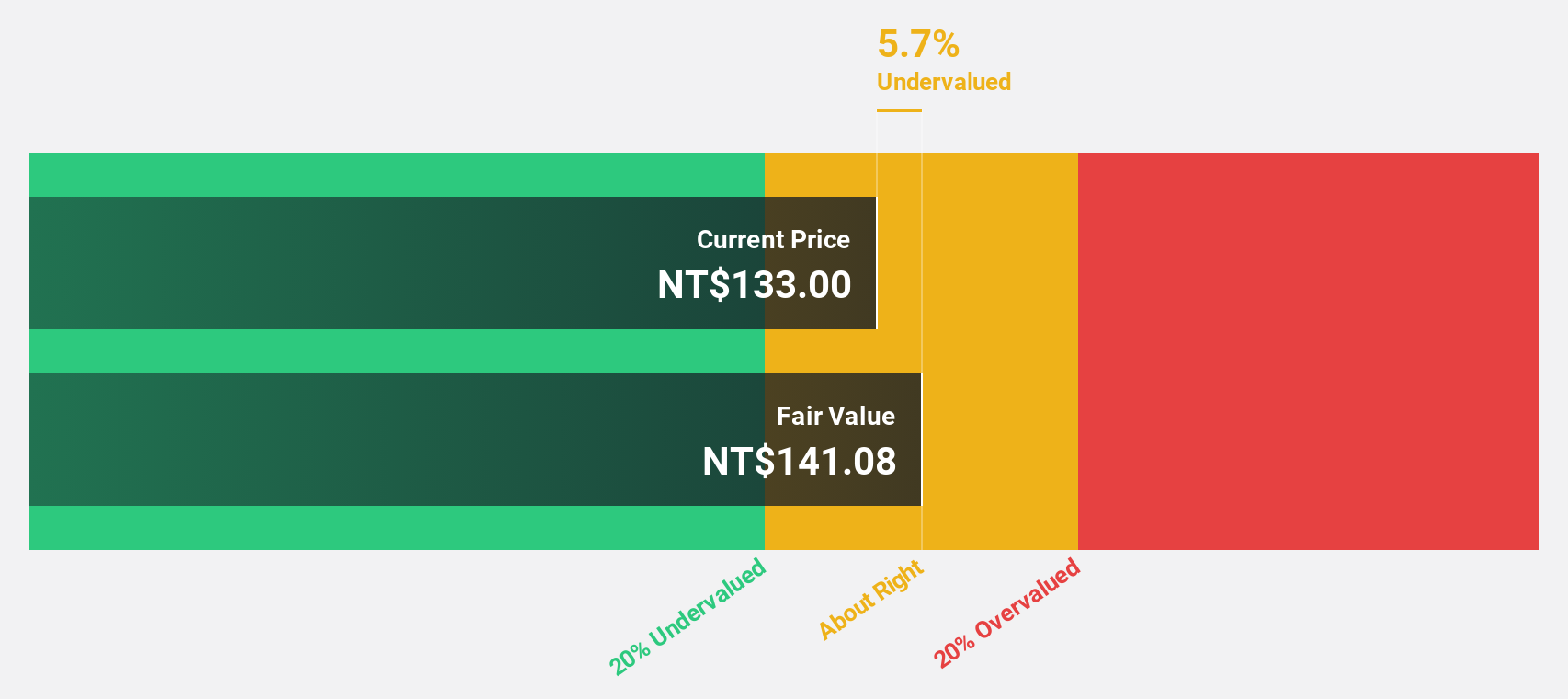

Overview: Lite-On Technology Corporation, along with its subsidiaries, operates as a global electronics company with a market cap of NT$373.41 billion.

Operations: The company’s revenue is primarily derived from the Information and Consumer Electronics Sector at NT$64.06 billion, followed by the Cloud and Internet of Things Department at NT$60.77 billion, and the Optoelectronic Department contributing NT$28.92 billion.

Estimated Discount To Fair Value: 38.9%

Lite-On Technology is trading at NT$166, considerably below its estimated fair value of NT$271.59, suggesting undervaluation based on cash flows. Recent participation in the OCP Global Summit showcased advanced AI data center solutions, potentially enhancing future revenue streams. Earnings are projected to grow significantly by 21.83% annually, outpacing the Taiwan market’s growth rate. However, the dividend yield of 2.71% isn’t well covered by free cash flows and share price volatility remains high.

Where To Now?

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com