Bond investors await interest rate cuts with a nervous eye on inflation, debt supply

While bond investors are optimistic about declining interest rates, there are concerns around inflation and debt supply.cagkansayin/iStockPhoto / Getty Images

For most investors, the traditionally slow and steady returns of bonds can be seen as a little boring. However, with central banks cutting interest rates and stocks looking overextended to some investors amid a record-setting run, bonds are receiving renewed attention.

“After a historic sell-off in 2022, bonds are finally offering meaningful yield and income again,” says Rose Devli, portfolio manager at 1832 Asset Management LP in Toronto.

“Bonds are again doing their job – protecting portfolios and paying investors to wait,” she says.

Ms. Devli notes that yields are close to their 15-year highs, giving investors real return potential. She points to easing inflation and central bank interest rate cuts as factors boosting bonds.

“The bottom line is fixed income is back to being a core stabilizer in overall portfolios,” she says.

Brianne Gardner, senior wealth manager and financial advisor with Velocity Investment Partners at Raymond James Ltd. in Vancouver, says the bond market is in “an interesting spot” between optimism over falling interest rates and concerns around inflation and debt supply.

She notes that bonds could be expected to perform even better with interest rates trending lower, but a few forces are keeping yields elevated.

First, inflation remains sticky. “If inflation hovers around 2 to 3 per cent, that becomes the floor investors require before lending money, so real returns are still modest,” Ms. Gardner says.

Second, there’s a lot of supply. “Governments, especially in the U.S., are issuing enormous volumes of debt to finance deficits, and that flood of issuance is keeping yields higher than they might otherwise be.”

As for preferences for term or type of bonds, Ms. Gardner says that given where we’re at in the interest rate cycle, she prefers short- to medium-term maturities in which yields remain attractive without taking on unnecessary duration risk.

She also favours high-quality corporate and government exposure, primarily through diversified funds, rather than reaching for yield in riskier credits.

For most clients, Ms. Gardner continues to hold bonds for diversification and stability, but is still underweight relative to historical norms.

Her firm uses a mix of actively managed bond funds and exchange-traded funds rather than individual bonds because professional portfolio managers typically have better access to inventory and can be more nimble.

“For us, it’s always about net return to the client and, right now, the [portfolio] managers we’re using are generating roughly 5 to 10 per cent net [returns] compared with about 3 to 5 per cent from most individual bonds.”

Some portfolio managers have a more negative view of the bond market and are looking elsewhere for fixed-income exposure.

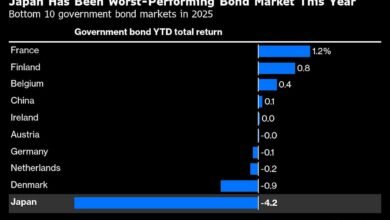

Martin Pelletier, senior portfolio manager with TriVest Wealth Counsel at Wellington-Altus Private Counsel Inc. in Calgary, says the U.S. bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, is experiencing “an unprecedented stretch of weakness” after 61 consecutive months of drawdowns through September.

In his opinion, the sustained decline has shaken investor confidence in what was once considered the most stable part of a portfolio. He notes bond market volatility has at times exceeded that of equities, undermining bonds’ role as a safe haven.

As a result, he says, the traditional portfolio model is breaking down under the weight of structural shifts such as fiscal indiscipline, liquidity distortions and political dysfunction.

In response, Mr. Pelletier’s firm has been reducing its sovereign debt exposure in both Canada and the U.S. He’s replacing government bond exposure not with corporate bonds, which he notes are trading at credit spreads close to 27-year lows, but with structured notes.

Structured notes are hybrid financial instruments that combine a bond with a derivative, allowing investors to tailor their exposure to various market scenarios.

Unlike traditional bonds, which offer fixed interest payments and principal protection, structured notes can provide enhanced income, downside buffers and exposure to equities, commodities and currencies.

Mr. Pelletier says this flexibility makes structured notes particularly attractive in today’s environment, in which sovereign debt is under pressure and traditional fixed income is failing to deliver.

Ms. Devli recommends active, diversified ETFs such as her firm’s Dynamic Active Tactical Bond ETF DXB-T.

“Active ETFs that can buy exposure in all fixed-income markets benefit the most,” she says. “Don’t just rely on one geography – active managers extract value globally when benchmarks don’t provide value.”

Ms. Devli says investors shouldn’t wait for the “perfect timing” to buy bonds and instead begin adding exposure if their portfolio doesn’t have any.

She also notes dividend stocks aren’t a substitute – “bonds are legal obligations, dividends are not” – and that guaranteed investment certificates do relatively poorly compared with bonds in an environment in which central banks are cutting interest rates.