Discover 3 Global Penny Stocks With Market Caps Larger Than US$40M

Global markets have been buoyant, with U.S. stocks reaching new highs amid expectations of interest rate cuts and optimism surrounding artificial intelligence advancements. As investors navigate these dynamic conditions, penny stocks—though often seen as a niche segment—continue to offer unique opportunities for growth, especially when backed by strong financial health. These smaller or newer companies can present affordable entry points with the potential for significant upside, making them an intriguing option for those seeking to diversify their portfolios.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.59 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$409.76M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.61 | MYR310.17M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.38 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.39 | MYR558.16M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.15 | SGD12.4B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.60 | $348.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.92 | €31.03M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,725 stocks from our Global Penny Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kaisa Health Group Holdings Limited is an investment holding company involved in the healthcare and dental business in China and internationally, with a market cap of HK$332.78 million.

Operations: The company generates revenue from its Dental Business, contributing HK$159.53 million, and its Health Care Business, which adds HK$6.89 million.

Market Cap: HK$332.78M

Kaisa Health Group Holdings, with a market cap of HK$332.78 million, operates in the healthcare and dental sectors. Despite being unprofitable, it has reduced losses by 32.7% annually over five years and expects further loss reduction for the first half of 2025. The company is debt-free with short-term assets covering both short- and long-term liabilities. Recent board changes include appointing Mr. Ye Haoda as an executive director, enhancing its leadership team amidst high share price volatility. Kaisa’s cash runway extends over three years if current free cash flow trends persist, providing financial stability in a challenging environment.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beyond Securities Public Company Limited operates in the securities sector in Thailand with a market capitalization of approximately THB3.23 billion.

Operations: The company generates revenue from its Investment Business, contributing THB719.63 million, and its Securities and Derivatives Business, which brings in THB414.43 million.

Market Cap: THB3.23B

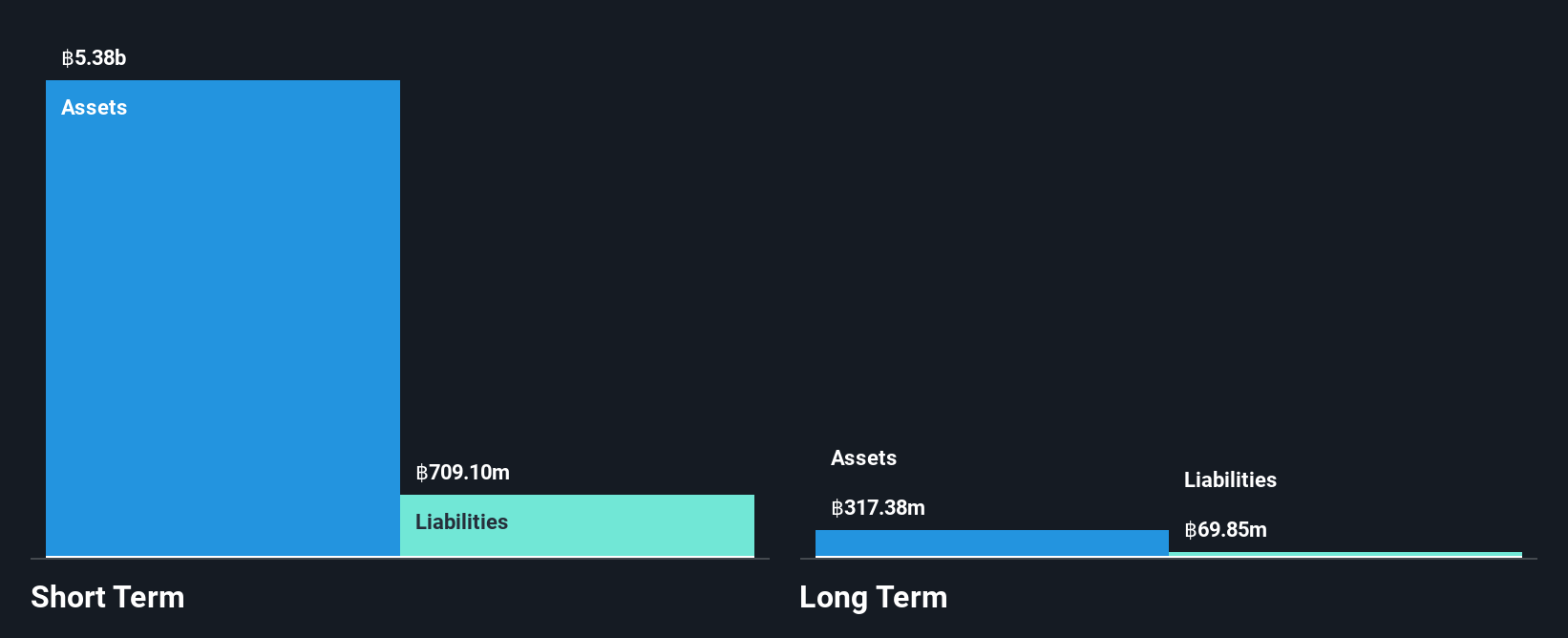

Beyond Securities Public Company Limited, with a market cap of THB3.23 billion, is navigating financial challenges as it reported a significant net loss for the recent quarter. Despite being unprofitable, the company maintains a stable cash runway exceeding three years due to positive free cash flow and no debt burden. Its short-term assets far surpass liabilities, providing some financial buffer. The management and board are experienced, though high share price volatility persists. While revenue from its investment and securities businesses is notable, overall earnings have declined sharply over five years at an annual rate of 71.7%.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Era Co., Ltd. engages in the research, development, production, and sale of plastic pipe products in China with a market cap of CN¥5.14 billion.

Operations: The company’s revenue primarily comes from its Manufacturing Industry segment, which generated CN¥6.05 billion.

Market Cap: CN¥5.14B

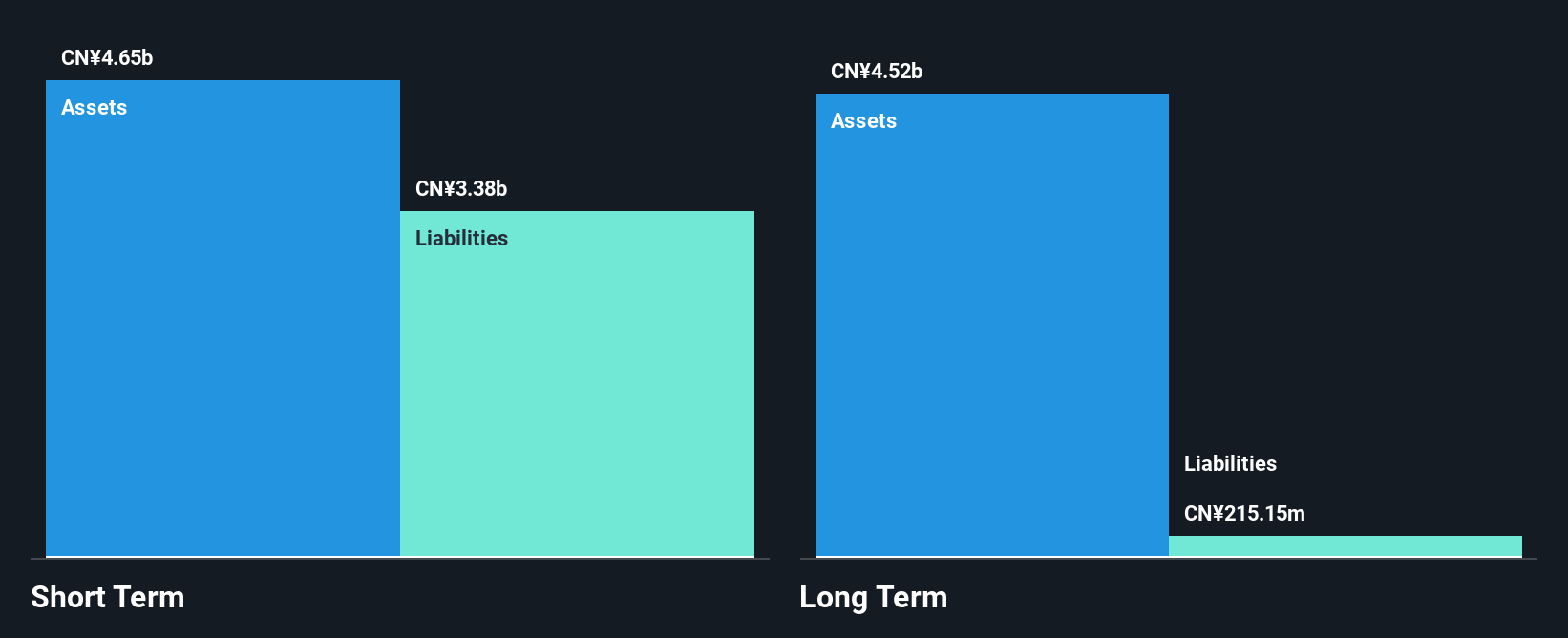

Era Co., Ltd. faces challenges as its recent earnings report shows a decline in revenue to CN¥2.91 billion and net income dropping to CN¥45.12 million, compared to the previous year. The company’s profit margins have decreased, and its return on equity remains low at 1.9%. Despite this, Era has strong short-term assets exceeding both long-term and short-term liabilities, offering some financial stability. However, the dividend is not well covered by free cash flows, raising sustainability concerns. While debt levels are manageable with more cash than total debt, negative operating cash flow poses risks for future obligations.

Seize The Opportunity

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Beyond Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Credit: Source link