Global Stocks Estimated To Be Trading Below Intrinsic Value By Up To 43.3%

As global markets continue to navigate the complexities of interest rate expectations and economic indicators, investors are keenly watching for opportunities amid fluctuating indices. With major U.S. stock indexes reaching new highs driven by AI optimism and anticipated Federal Reserve rate cuts, the search for stocks trading below their intrinsic value becomes increasingly relevant. In such an environment, a good stock is often characterized by its potential to deliver value despite broader market trends, offering investors a chance to capitalize on perceived undervaluations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK61.40 | SEK122.64 | 49.9% |

| Kuraray (TSE:3405) | ¥1756.00 | ¥3488.37 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩78700.00 | ₩156214.35 | 49.6% |

| Inner Mongolia Xingye Silver&Tin MiningLtd (SZSE:000426) | CN¥25.61 | CN¥50.97 | 49.8% |

| Gofore Oyj (HLSE:GOFORE) | €14.88 | €29.64 | 49.8% |

| Food Empire Holdings (SGX:F03) | SGD2.59 | SGD5.16 | 49.8% |

| Faraday Technology (TWSE:3035) | NT$150.00 | NT$299.86 | 50% |

| Dogus Otomotiv Servis ve Ticaret (IBSE:DOAS) | TRY169.60 | TRY336.86 | 49.7% |

| Brockhaus Technologies (XTRA:BKHT) | €9.64 | €19.22 | 49.8% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.79 | 49.6% |

Let’s dive into some prime choices out of the screener.

Overview: Fertiglobe plc, along with its subsidiaries, is engaged in the production and sale of nitrogen-based products across Europe, North and South America, Africa, the Middle East, Asia, and Oceania with a market capitalization of AED20.41 billion.

Operations: Fertiglobe’s revenue is primarily derived from the production and marketing of owned produced volumes, amounting to $2.03 billion, and third-party trading activities, which contribute $193.80 million.

Estimated Discount To Fair Value: 17.1%

Fertiglobe’s current trading price of AED2.46 is below its estimated fair value of AED2.97, indicating potential undervaluation based on cash flows. Despite a high debt level and slower revenue growth forecast compared to the AE market, earnings are expected to grow significantly at 23.8% annually, surpassing market averages. However, profit margins have declined from last year and dividends are not well covered by earnings, raising concerns about financial sustainability in the short term.

Overview: Korea Circuit Co., Ltd. produces and sells printed circuit boards globally, with a market cap of ₩436.45 billion.

Operations: The company generates revenue primarily from the manufacture of printed circuit boards, totaling ₩1.36 billion.

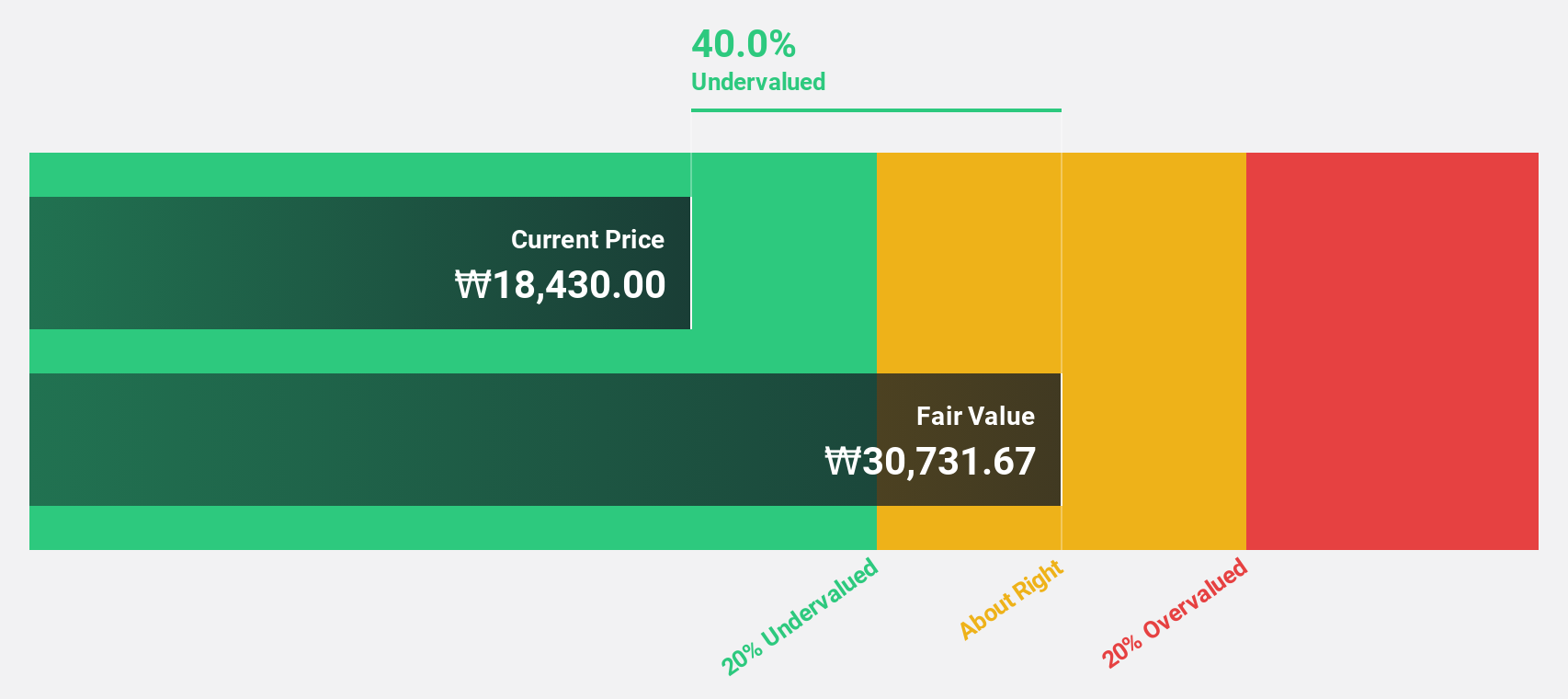

Estimated Discount To Fair Value: 43.3%

Korea Circuit’s current price of ₩17,490 is significantly below its estimated fair value of ₩30,828.76, highlighting potential undervaluation. Although revenue growth is modest at 7.3% annually, it outpaces the KR market average and the company is expected to become profitable within three years with earnings growth forecasted at 88.67% per year. Despite a low projected return on equity of 11.6%, Korea Circuit offers good relative value compared to peers and industry standards.

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, manufactures electronic products globally and has a market cap of THB63.22 billion.

Operations: The company’s revenue is primarily derived from its Computer Peripheral segment at THB161.78 billion and Telecommunication Products at THB23.83 billion, with additional income from Service Income amounting to THB1.71 billion.

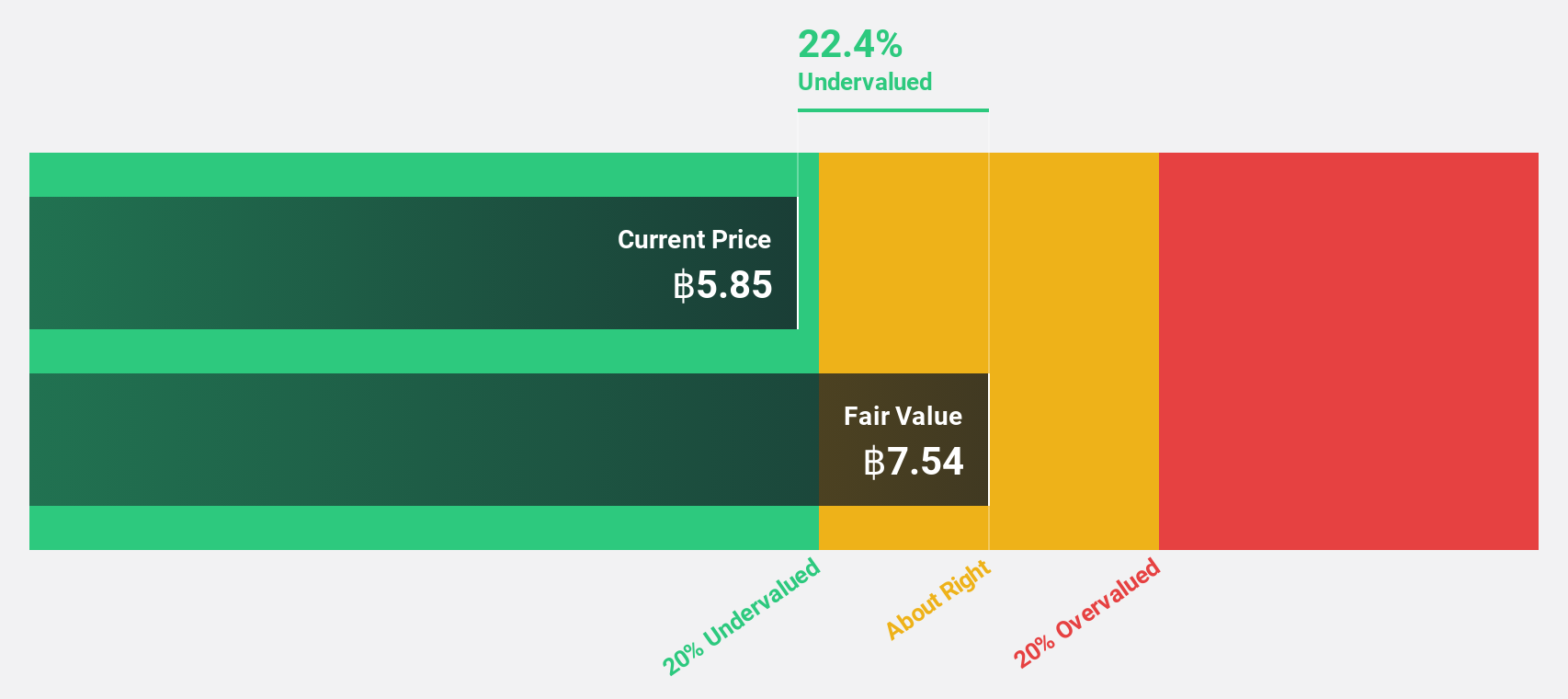

Estimated Discount To Fair Value: 21.3%

Cal-Comp Electronics (Thailand) is trading at a discount, with its current price below the estimated fair value of THB 7.69, indicating potential undervaluation based on cash flows. Despite a high debt level and declining recent sales, its earnings are forecast to grow significantly at 20.4% annually, outpacing the Thai market average. The company has declared an interim dividend of THB 0.07 per share for the first half of 2025, reflecting stable cash flow management amidst fluctuating revenues.

Seize The Opportunity

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Korea Circuit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Credit: Source link