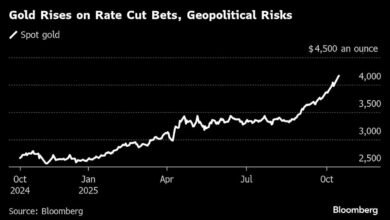

Gold price climbs to new peak as US-China trade tension fuels safe-haven demand. Will this rally sustain till Diwali?

Gold price continues to see bull run on Tuesday driven by rising concerns over US tariffs and expectations of additional rate cuts by the US Federal Reserve, which continue to boost safe-haven demand.

On Tuesday, MCX December gold future rates climbed more than ₹2,000, or over 1.6 per cent, reaching a record ₹1,26,652 per 10 grams. Meanwhile, MCX December silver futures jumped over ₹7,400, or nearly 5%, to hit a fresh high of ₹1,62,057 per kilogram.

Gold prices are surging as global political and economic uncertainties intensify. Renewed trade tensions between the world’s two largest economies—the US and China—have sparked concerns over potential disruptions to global trade and economic growth.

US President Donald Trump has announced a 100 per cent tariff on Chinese goods and imposed export controls on key US-made software, set to take effect on November 1, in response to China’s move to broaden its rare-earth export restrictions.

“Gold prices opened sharply higher with a strong gap up of ₹2,000, trading above ₹1,26,600 per 10 grams, as renewed U.S.-China trade tensions reignited safe-haven demand. The U.S. administration’s announcement of a 100% tariff hike on select Chinese products, coupled with China’s threat to restrict rare earth exports, has heightened global uncertainty and risk aversion. This geopolitical tension, along with sustained demand from investors seeking safety, continues to keep gold’s outlook bullish,” said Jateen Trivedi, VP Research Analyst – Commodity and Currency, LKP Securities.

Will the rally sustain by Diwali 2025?

Aksha Kamboj, Vice President, India Bullion & Jewellers Association (IBJA) and Executive Chairperson, Aspect Global Ventures, believes that the bullion is likely to witness further volatility ahead of festive season.

“Given India’s festive spending and heightened geopolitical risks, we expect the trend to retain the potential for a further hike, though we will keep an eye on potential short-term corrections. Going forward, we will likely see further volatility as global decisions about rates and the dollar affect the market,” Kamboj said.

On the other hand, Rahul Kalantri, VP Commodities, Mehta Equities Ltd, said that the momentum in gold prices is likely to continue in the coming weeks.

“Gold posted its eighth consecutive weekly gain, while silver saw profit-taking after nine straight weeks of advance. Although investors turned cautious at record highs, the broader trend remains positive, and bullish momentum is likely to continue in the coming weeks. Gold has support at $3965-3930 while resistance at $4050-4075. In INR gold has support at Rs1,20,670-1,19,980 while resistance at Rs1,22,450-1,22,950,” Kalantri added.

Disclaimer: This story is for educational purposes only. The views and recommendations above are those of individual analysts or broking companies, not Mint. We advise investors to check with certified experts before making any investment decisions.