Gold pulls back as markets await Fed speeches and core PCE inflation data

Gold (XAUUSD) remains under pressure after pulling back from recent highs. The metal continues to react to shifting expectations of U.S. monetary policy. Recent hawkish comments from the Fed have lowered rate-cut expectations, boosting the Dollar and capping gold’s gains. At the same time, rising geopolitical tensions, especially surrounding the Russia-Ukraine conflict, have reinforced gold’s safe-haven appeal. Looking ahead, markets are now focused on upcoming U.S. economic data and core PCE inflation. Gold’s next move will depend on how policy signals and global risks unfold.

Gold pulls back ahead of core PCE inflation and Fed policy signals

Gold has retreated from recent highs, staying sensitive to shifting U.S. policy expectations. Markets now price in just 43 basis points of Fed easing for the rest of the year, down from earlier projections. This adjustment follows a series of hawkish comments from Fed officials, who highlighted persistent inflation risks. Consequently, a stronger U.S. Dollar has capped gold’s short-term gains, although its broader trend remains bullish.

In parallel, ongoing global conflicts continue to support demand for gold. Specifically, the Russia-Ukraine conflict has regained market attention. This follows strong warnings from Ukrainian President Volodymyr Zelensky and renewed rhetoric from Kremlin officials at the UN General Assembly. These heightened tensions have reinforced gold’s safe-haven appeal, supporting demand even as monetary headwinds persist.

Looking ahead, gold’s near-term direction will be shaped by upcoming U.S. data and commentary from Fed officials. In particular, reports on Durable Goods, Jobless Claims, and Existing Home Sales are expected to offer early clues on economic momentum. Moreover, several Federal Reserve officials are scheduled to deliver speeches this week. Markets will closely analyze their tone for any shifts in the policy outlook, with Friday’s core PCE inflation data in focus.

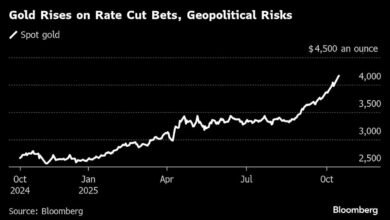

Gold surges past channel resistance after an extended consolidation phase

The gold chart below shows a classic breakout setup within a well-defined ascending channel. Since 2020, gold has climbed steadily, repeatedly finding support at the lower trendline. This consistent behavior reinforced bullish control throughout the structure. Meanwhile, the upper trendline consistently acted as resistance, rejecting multiple rally attempts and triggering notable reversals over time.

Following a steady climb, price action began to tighten just beneath the upper boundary of the ascending channel. As a result, candles became smaller and volatility decreased, creating a well-defined consolidation zone. Typically, this kind of price behavior sets the stage for an explosive move. At the same time, price action formed a broad cup-shaped base, signaling steady accumulation and supporting the continuation of upward momentum.

Eventually, the consolidation phase resolved with a decisive breakout. A strong bullish candle closed firmly above the channel’s upper boundary, confirming a shift in momentum. Since then, gold has remained above this former resistance zone, further strengthening the breakout’s strength. This technical move aligns with a supportive macro backdrop. Specifically, easing inflation pressures and escalating geopolitical risks continue to enhance gold’s safe-haven appeal. With both technical and fundamental factors aligned, gold now appears poised for a sustained move higher.

Gold outlook: Inflation data and Fed speeches to guide direction

Gold has pulled back from recent highs but remains near key breakout levels as markets weigh shifting expectations for U.S. monetary policy. The decline followed hawkish remarks from the Fed and renewed strength in the U.S. Dollar. However, rising geopolitical tensions continue to support its status as a safe haven. Markets remain cautious, awaiting fresh guidance from upcoming U.S. economic data and Fed speeches. With core PCE inflation data approaching, markets may soon gain a clearer direction on interest rate expectations and the next move for gold.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Credit: Source link