Has West Pharma’s Recent Share Rebound Outpaced Its Fundamentals in 2025?

Are you wondering whether it’s the right time to add West Pharmaceutical Services to your portfolio, hold out for a better price, or cash in your gains? You’re not alone. The health care packaging leader has been making some interesting moves in the market, with its share price rising 3.4% over the past week and 5.4% in the last month, even as it’s down a noticeable 17.6% year-to-date. Zooming further out, the one-year return is a modest -7.5%. The stock is still up 17.1% over the last three years, though it trails with a -2.8% five-year return.

If you’ve been watching the sector, you’ll know the recent uptick in West’s stock seems to reflect a broad pickup in risk appetite among investors, alongside increased optimism about the company’s role in global healthcare supply chains. Yet, despite the recent positive momentum, valuation remains a big question mark for West. According to our value score, which measures a stock on six key metrics, West tallies zero out of six in terms of undervaluation signals.

With this in mind, let’s take a closer look at what those valuation approaches really say about West Pharmaceutical Services, and why understanding the numbers is only part of the puzzle. Stay tuned for an even more holistic way to think about valuation by the end of our analysis.

West Pharmaceutical Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: West Pharmaceutical Services Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s terms. This method gives investors a sense of what the business is fundamentally worth, independent of where the share price happens to be.

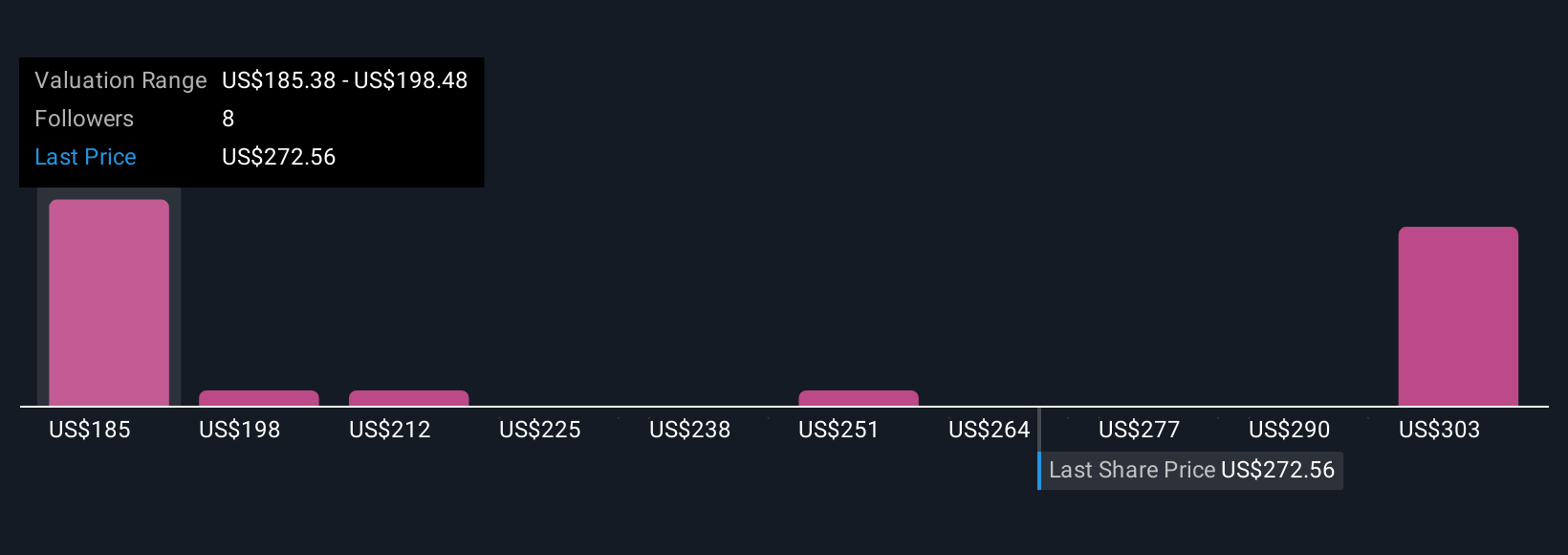

West Pharmaceutical Services currently generates free cash flow of $323.6 million. According to analyst projections, free cash flow is expected to steadily grow, reaching $542 million by 2028. Beyond this period, additional estimates are extrapolated, forecasting rising cash flows through 2035, but these further out years naturally come with greater uncertainty.

When all these projected cash flows are discounted to their present value using a two-stage Free Cash Flow to Equity approach, the resulting intrinsic value for West comes in at $185.06 per share. Despite the healthy cash flow growth, this DCF model implies West shares are trading at a 46.2% premium to their intrinsic value. This suggests the stock is overvalued when looking through the lens of cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests West Pharmaceutical Services may be overvalued by 46.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: West Pharmaceutical Services Price vs Earnings

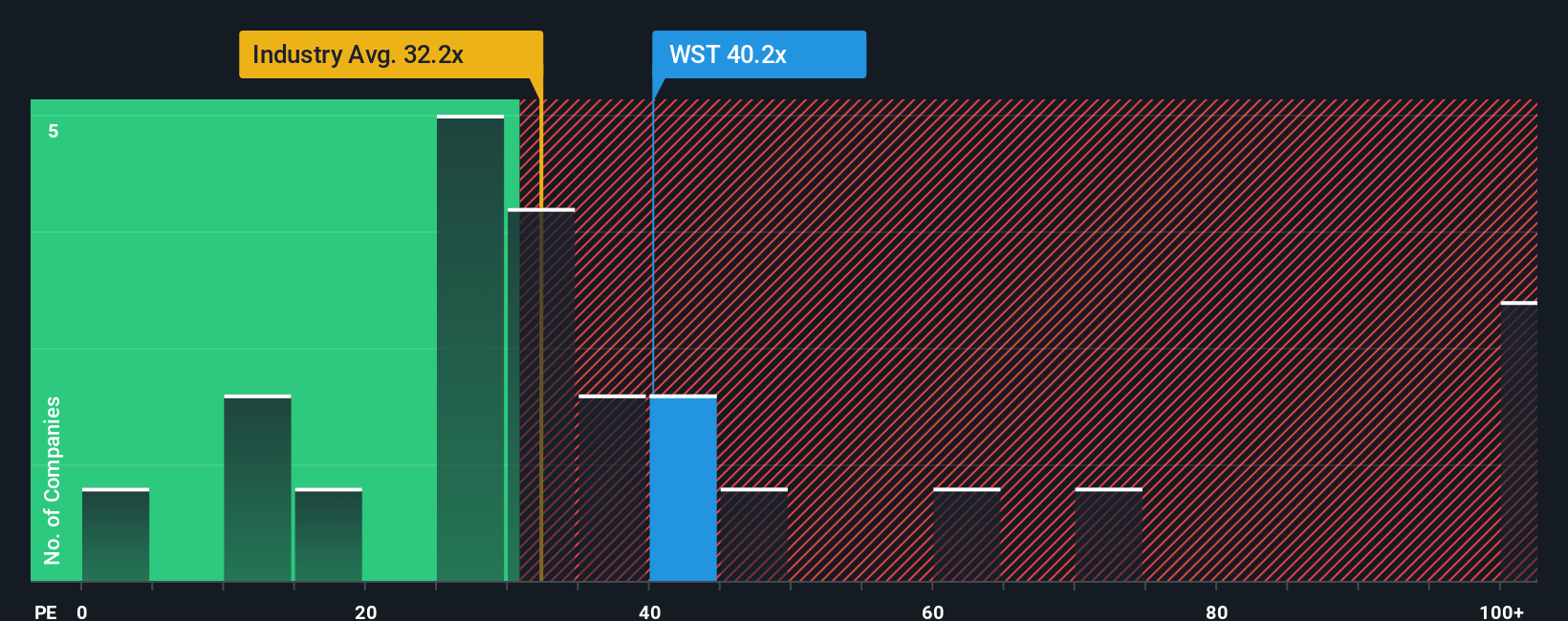

For profitable companies like West Pharmaceutical Services, the price-to-earnings (PE) ratio is a widely used and effective way to gauge valuation. The PE ratio shows how much investors are paying for each dollar of earnings, making it especially meaningful for businesses with steady profits.

Growth expectations and risk both play a significant role in shaping what is considered a “normal” or “fair” PE ratio. Companies expected to deliver robust earnings growth or those with more predictable earnings streams typically command higher PE ratios. In contrast, higher risk or slower growth tends to pull the multiple down.

Currently, West trades at a PE ratio of 39.9x. This stands well above the industry average of 33x and also exceeds the peer group’s average of 23.4x, signaling the market’s high expectations for the company. However, Simply Wall St’s proprietary Fair Ratio model calculates a fair PE for West at 25.3x. This “Fair Ratio” is more comprehensive than a simple industry or peer comparison because it accounts for factors unique to West, such as its earnings growth prospects, profit margin, industry background, market cap, and the level of business risk.

With its actual multiple of 39.9x sitting notably above the Fair Ratio of 25.3x, West Pharmaceutical Services appears overvalued on a PE basis at the current price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your West Pharmaceutical Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own perspective or story about a company, based on your interpretation of its future prospects and the assumptions that drive your view on its fair value, such as how fast revenue or earnings will grow or what profit margins might look like over time.

With Narratives, you link a company’s unique story to your financial forecasts and see how that shapes your opinion of its intrinsic value, rather than only relying on current market multiples or analyst estimates. On Simply Wall St’s Community page, millions of investors can build and share Narratives for stocks like West Pharmaceutical Services, all with just a few clicks.

Narratives help you make smarter buy or sell decisions by clearly showing how your Fair Value compares to the current Price, and they automatically update as new information like earnings reports or news comes in. For West Pharmaceutical Services, for example, some investors see upside to $350 based on strong demand for high-value products and margin expansion, while others see a more conservative $260 price due to risks from demand shifts and tariffs. This lets you easily compare a range of outcomes in one place.

Do you think there’s more to the story for West Pharmaceutical Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com