Is Now the Right Time for AngloGold Amid Gold Price Surge in 2025?

If you’ve been tracking AngloGold Ashanti lately and wondering whether now is the right moment to make a move, you’re certainly not alone. The stock’s performance has been nothing short of eye-catching, with a 222.7% gain this year and a surge of 19.7% just over the past month. Even looking further back, its three-year total return stands at a whopping 556.6%. With numbers like these, it is only natural to ask whether all the good news is already priced in, or if there is still value left on the table.

What is behind these jumps? AngloGold Ashanti has benefited from broader market developments in the gold sector, where shifting global economic sentiment and interest in hard assets have drawn attention to miners. Investors are also keeping an eye on evolving geopolitical tensions and inflationary pressures, both of which have driven increased interest in gold as a safe haven, boosting share prices for leading producers like AngloGold Ashanti.

But great returns alone do not guarantee that a stock remains a bargain. On a composite valuation score, AngloGold Ashanti checks 3 out of 6 key undervaluation boxes, suggesting that while the company is undervalued in several important areas, there are also factors keeping its score from being higher.

So how do you figure out if there is still value here, or if you are arriving late to the party? Next, we will break down AngloGold Ashanti’s standing using several tried-and-true valuation methods. Stay tuned, as there is an even more insightful approach to understanding this company’s worth waiting at the end of the article.

Approach 1: AngloGold Ashanti Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s dollars. This method allows investors to gauge what the business is truly worth right now, based on expected cash generation.

For AngloGold Ashanti, the DCF model uses the company’s most recent Free Cash Flow of $1.46 billion as a starting point. Analysts have forecasted FCF to grow substantially, with projections reaching $2.46 billion in 2028. Beyond five years, team analysts have extrapolated future numbers out to 2035, albeit with expected declines after the strongest growth years.

Bringing all these projected cash flows back to the present, the DCF analysis estimates an intrinsic value of $60.16 per share. However, comparing this figure to AngloGold Ashanti’s current share price, the stock looks to be 30.6% overvalued according to this metric. This suggests that, at present, much of the anticipated growth and good news may already be reflected in the price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AngloGold Ashanti may be overvalued by 30.6%. Find undervalued stocks or create your own screener to find better value opportunities.

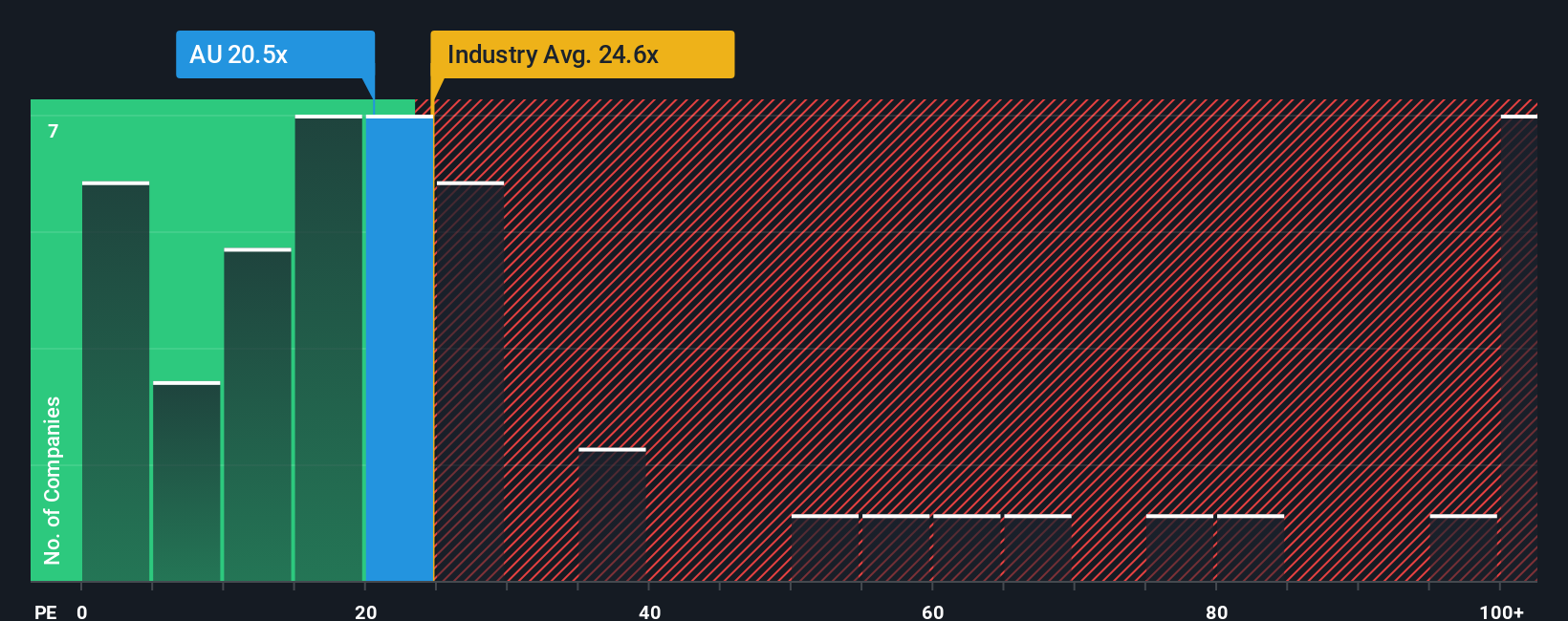

Approach 2: AngloGold Ashanti Price vs Earnings

The Price-to-Earnings (PE) ratio remains one of the most widely used metrics for valuing profitable companies, as it directly compares a company’s share price to its per-share earnings. This approach is especially helpful for companies like AngloGold Ashanti, where healthy profits make the PE ratio a reliable indicator of value.

A “normal” or fair PE ratio depends on several factors, including how quickly company earnings are expected to grow and what risks might challenge those future profits. Fast-growing, stable companies tend to command higher PE multiples. Slower-growing or riskier businesses usually see lower ratios.

Currently, AngloGold Ashanti trades at a PE of 22x. This sits below both its peer group average of 39.2x and the broader Metals and Mining industry average of 25.5x. This may indicate a more conservative valuation by the market. However, comparisons to simple averages might not reflect all the unique attributes and risks relevant to AngloGold Ashanti.

This is where Simply Wall St’s proprietary Fair Ratio comes in. In this case, it is 30.8x. The Fair Ratio adjusts for factors such as the company’s expected earnings growth, industry conditions, profit margins, market cap, and company-specific risks. Because the Fair Ratio synthesizes all these elements, it offers a more tailored benchmark than basic peer or industry multiples.

Comparing AngloGold Ashanti’s actual PE of 22x to the Fair Ratio of 30.8x suggests the stock is undervalued using this method, even after accounting for its risks and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AngloGold Ashanti Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. This is a more powerful, dynamic, and intuitive way to make smarter investment choices. A Narrative is your own story behind the numbers, combining your perspective about a company’s future and its catalysts with a tailored financial forecast and fair value estimate.

Narratives bridge the gap between what you know about AngloGold Ashanti and what you believe will drive its value. You can easily input your revenue, margin, and risk expectations, and then instantly see how these translate into a personal fair value. Because Narratives are dynamic and update automatically with new events (such as news or earnings), you never have to worry about outdated assumptions skewing your decisions.

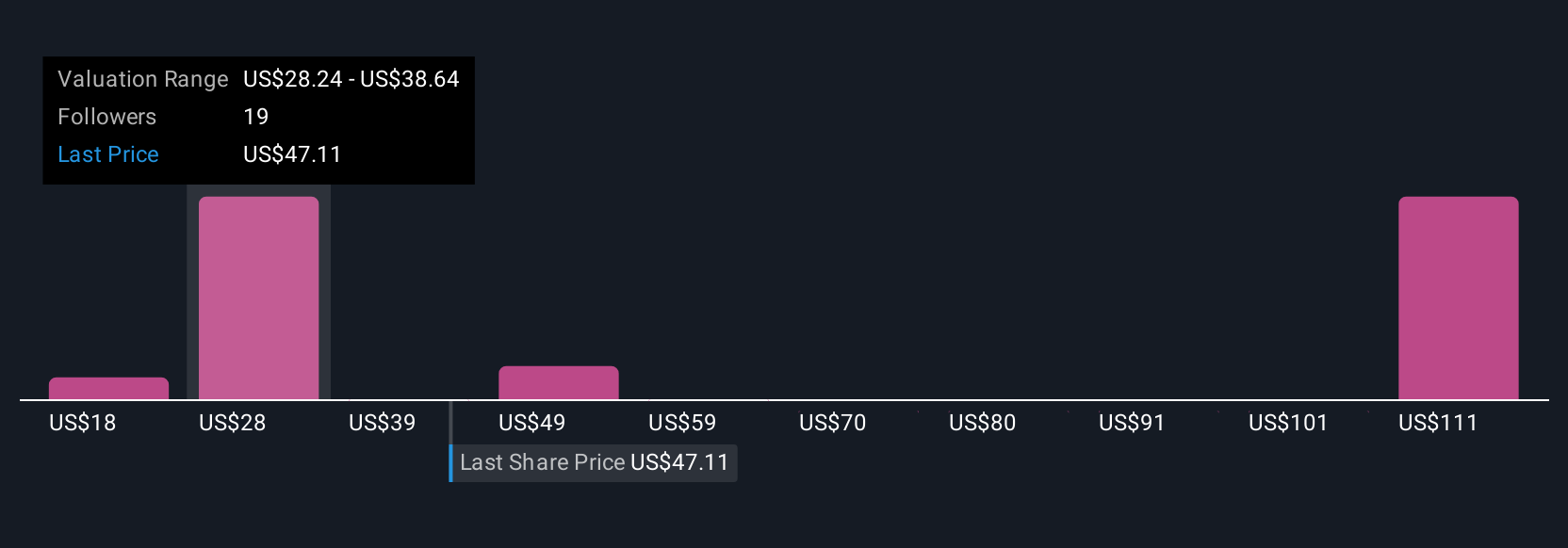

Millions of investors already use Narratives on the Simply Wall St platform’s Community page to compare fair value versus price and decide when to buy or sell. The process is accessible, interactive, and suited for both beginners and experienced investors. For instance, some investors expect AngloGold Ashanti to achieve robust revenue growth and assign a fair value as high as $70 per share, while others focus on cost risks and set a lower fair value closer to $38. Narratives empower you to confidently assess which story is most likely and act on it with clarity.

Do you think there’s more to the story for AngloGold Ashanti? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com