Kangaroo Bonds Turbocharge on US Dollar Diversification

Australian dollar-denominated bonds from international issuers, or so-called kangaroo bonds, are seeing strong traction lately, with our DCM and A$ syndicate teams having an active year advising notable issuances from across Canada, Europe, the Middle East and Korea, with many of these transactions netting record order books.

While demand for kangaroo bonds traditionally came from investors in Australia and Asia Pacific, the market is increasingly attracting global attention as the world looks for US dollar diversification. While we believe full-fledged de-dollarization is unlikely, the US dollar will likely be weaker and more volatile. As a result, investors who work in treasuries or asset liability management roles are looking to manage risk by diversifying their investments beyond US dollar assets.

While this has led to increased interest in alternate currencies such as the euro and Japanese yen too, the Australian dollar has emerged as a particularly attractive option following three rate cuts by the Reserve Bank of Australia this year – the local yield curve remains steep which brought into play the ability for bank treasuries, particularly those in Asia, to enjoy a favorable cost-of-carry. With the markets expecting rates to go lower and fiscal challenges to continue, we are in a Goldilocks moment where front end rates in Australia are lower, global yields are higher, and investors are seeking to diversify away from US treasuries and dollars.

The Australian dollar market also offers compelling yields compared to other major currencies. While the five-year US dollar swap rate stands at approximately 3.38%, the Australian dollar equivalent is 3.71%. This compares favorably to other alternatives such as the euro (2.38%), Singapore dollar (1.53%), and Japanese yen (1.16%). The Australian economy remains resilient, with a relatively low debt-to-GDP ratio at 40-50%, so its high yields are attractive compared to markets where fiscal concerns are more prominent.

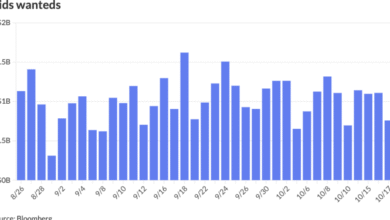

Deep local investor base and AUD liquidity

After the pandemic as rates went lower, Australia’s active fund management industry has seen significant growth and large amounts of capital has flowed into fixed income away from cash. In late 2024, Australian regulators announced the phasing out of bank hybrid bonds, which were popular among retail investors for yield enhancement, but deemed ineffective at absorbing losses in the event of a crisis. Not only is there no additional supply now, but these hybrid bonds are being redeemed, which means there’s sizable amounts of money coming back into the market. That partly explains the record order books on the kangaroo bonds we’ve been underwriting in the subordinated bank market.

The Australian dollar market has also evolved significantly, offering superior liquidity compared to other Asian currencies. For large transactions, such as billion-dollar interest rate swaps, execution has become more efficient and cost-effective. While not yet as deep as US dollar or euro liquidity levels, the Australian dollar market has robust DM trading infrastructure across government bonds, semi-government bonds, and credit products – Nomura is active and has dedicated headcount in each of these markets. As a Tokyo-headquartered institution, we also see and have access to some unique flows from Japan into the Australian dollar market especially into the semi-government bonds.

Looking ahead

The combination of attractive yields, a strong economy and improving market infrastructure suggests the Australian dollar bond market will continue to play an increasingly important role in global fixed income portfolios, particularly for investors seeking yield and diversification in the Asian time zone. Recent landmark transactions and larger deal sizes create a virtuous cycle, attracting more investors globally.

Nomura’s stronghold in Asia and its full investment banking and global markets capabilities on the ground in Australia place us in an advantageous position and has helped us maintain our top 2 ranking in kangaroo bonds underwriting.

By Oliver Holt, Head of Debt Syndicate and IG Origination, Asia ex-Japan

Reach him and the team on audsyndicate@nomura.com.