Microbix Biosystems Leads These 3 TSX Penny Stocks

As the Canadian market navigates through a period of uncertainty, with central banks offering limited guidance on future policy directions, investors are keeping a close eye on economic indicators to gauge potential interest rate cuts. In such volatile times, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area due to their affordability and growth potential. These smaller or newer companies can offer significant returns when backed by strong financials, and this article will explore three noteworthy examples from the TSX that demonstrate both stability and promise.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.00 | CA$72.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$23.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.32 | CA$2.67M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$48.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.25 | CA$818.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.12 | CA$21.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.43 | CA$403.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.51 | CA$177.64M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$200.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.70 | CA$8.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microbix Biosystems Inc. is a life science company that develops and commercializes proprietary biological and technological solutions for human health across North America, Europe, and internationally, with a market cap of CA$37.04 million.

Operations: The company’s revenue is primarily generated from product sales amounting to CA$21.07 million, with additional income from licensing fees and royalties totaling CA$0.06 million.

Market Cap: CA$37.04M

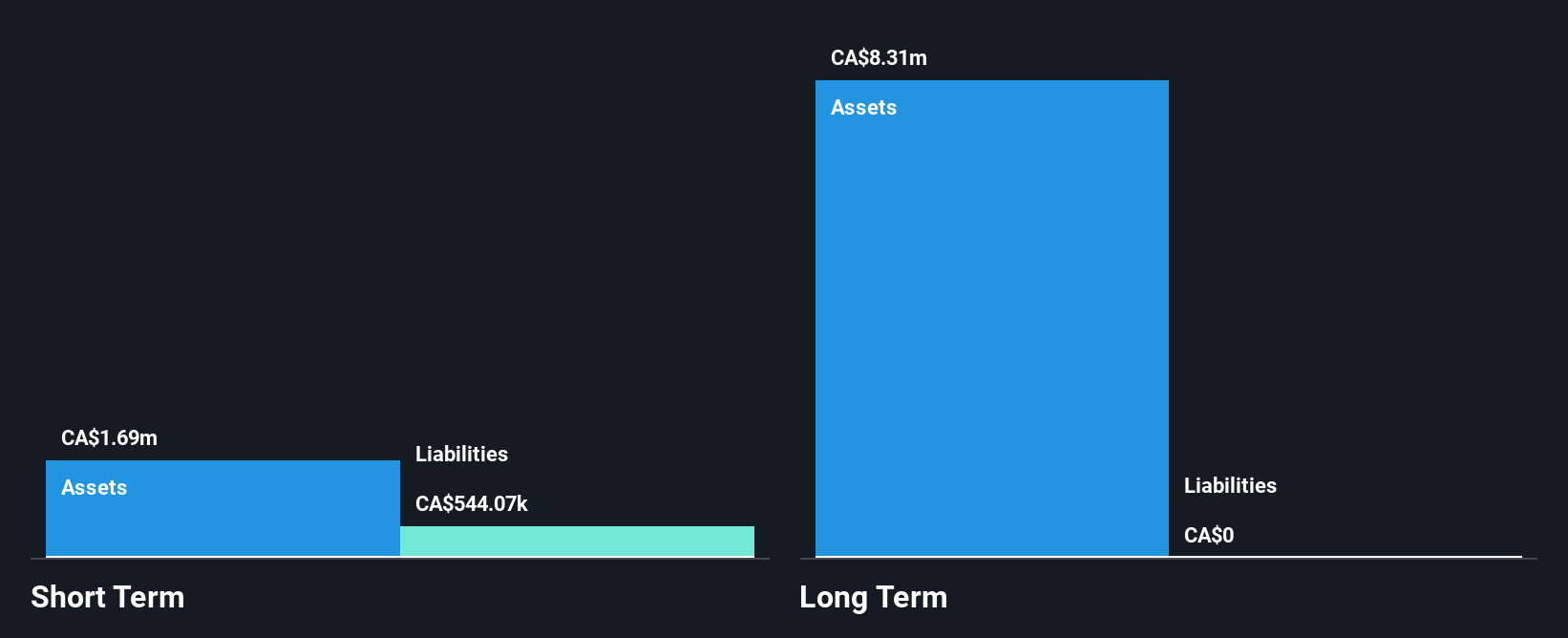

Microbix Biosystems, with a market cap of CA$37.04 million, is navigating challenges typical of penny stocks. Despite being unprofitable, it has reduced losses over five years and maintains a stable cash position with short-term assets exceeding liabilities. Recent initiatives include launching the QUANTDx product line and partnering with EMQN CIC to enhance genetic testing accuracy for antiplatelet drug metabolism—a move that could bolster its revenue streams. The company also completed a share buyback program, indicating confidence in its valuation. Management’s seasoned experience further supports its strategic direction amidst industry volatility.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscount Mining Corp. is involved in the evaluation and exploration of mineral properties in the United States, with a market cap of CA$93.31 million.

Operations: Viscount Mining Corp. currently does not report any revenue segments.

Market Cap: CA$93.31M

Viscount Mining Corp., with a market cap of CA$93.31 million, is pre-revenue and focuses on mineral exploration in the U.S. The company is debt-free, with short-term assets covering liabilities, offering some financial stability despite its unprofitable status. Recent exploration at the Silver Cliff Project in Colorado has shown promising developments, particularly at the Kate Silver Resource and Passiflora porphyry Copper-Gold deposit. With silver prices recently surging past US$40/oz, these projects could gain economic significance. However, Viscount’s cash runway remains limited to less than a year if current free cash flow trends persist.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vulcan Minerals Inc. focuses on acquiring, evaluating, and exploring mineral properties in Newfoundland and Labrador with a market cap of CA$20.69 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$20.69M

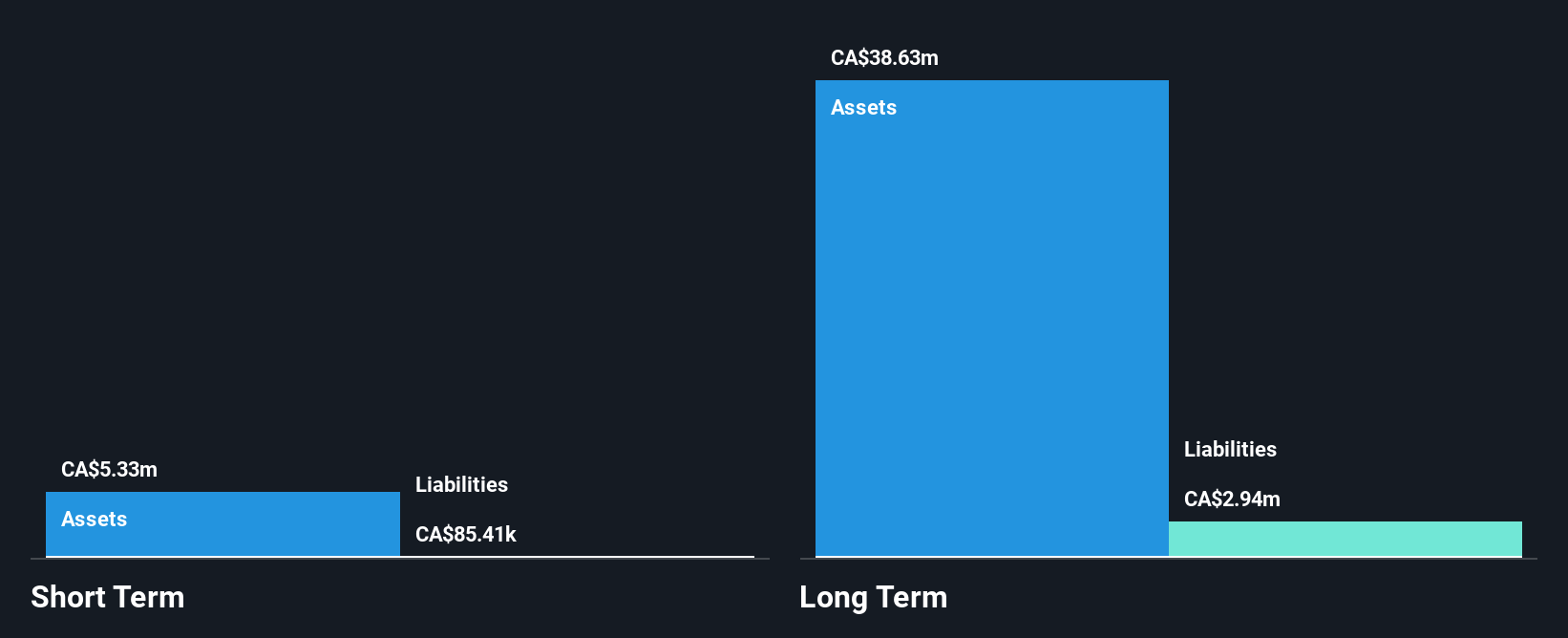

Vulcan Minerals Inc., with a market cap of CA$20.69 million, is pre-revenue and focuses on mineral properties in Newfoundland and Labrador. The company has no debt, providing a measure of financial flexibility, and its short-term assets of CA$5.3 million cover both short-term (CA$85.4K) and long-term liabilities (CA$2.9M). Despite these strengths, Vulcan remains unprofitable with losses increasing over the past five years at 27.3% annually. The board’s average tenure is 6.9 years, indicating experienced oversight; however, the stock’s high volatility poses risks for investors seeking stability in penny stocks.

Taking Advantage

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Credit: Source link