The Bubble in the ‘Magnificent Seven’ Tech Stocks Is Not Yet Over, with Further Upside Potential Remaining

①Bank of America strategists stated that the bubble formed in large U.S. technology stocks over the past two years still has room to expand further. ②Investors’ strong optimism toward U.S. tech giants has driven the U.S. stock market to repeatedly reach new historical highs this year, with no signs of weakening.

Cailian Press report on September 19 (edited by Xia Junxiong): Bank of America strategists stated that the bubble formed in large U.S. technology stocks over the past two years still has room to expand further.

The Bank of America team led by Michael Hartnett studied ten equity bubbles since the early 20th century and found that the average increase during these periods of extreme high valuations (from trough to peak) was 244%.

In a report, they wrote that this implies that the Mag 7 still have “room for further increases.” Since the low point in March 2023, the seven giants have collectively risen by 223%.

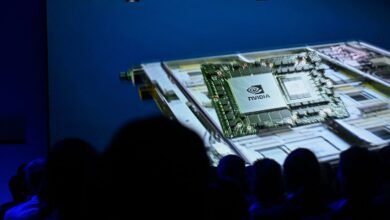

These seven companies include: NVIDIA, Microsoft, Apple, Alphabet (Google’s parent company), Amazon, Meta, and Tesla.

The strategists noted that the current valuation levels also support this view. Past stock market bubbles typically ended when price-to-earnings (P/E) ratios reached as high as 58x, with stock prices being 29% above their 200-day moving average.

By comparison, the P/E ratio of these seven stocks is 39x, which is only 20% above their 200-day moving average. Therefore, Hartnett and his team consider them the “most representative examples of the current bubble.”

Investor enthusiasm for U.S. tech giants has driven the U.S. stock market to repeatedly reach new historical highs this year, showing no signs of weakening. As investors continued buying on dips, the S&P 500 Information Technology Index surged 56% from its April low.

A favorable macroeconomic environment, the sustained boom in artificial intelligence (AI), and expectations of further interest rate cuts by the Federal Reserve have all become tailwinds for this sector.

In fact, a Bank of America survey of fund managers released this week showed that “going long on the seven giants” was considered the most crowded trade for the second consecutive month, with 42% of respondents holding this view.

Hartnett and his team pointed out that bubbles tend to be short-lived and highly concentrated. During the 2000 dot-com bubble, related stocks soared to extreme levels, with the technology sector surging 61% within six months, while all other sectors of the S&P 500 index declined during the same year.

Analysts also noted that, at the same time, investors should hedge against the risk of a tech giant bubble by allocating ‘distressed value stocks,’ as this kind of extreme high-valuation frenzy often drives economic growth in its unfolding.

Hartnett stated that current potential investment opportunities of this kind include Brazil, the UK, and global energy stocks.

Credit: Source link