The World’s Largest Crypto Market

Note on our methodology: In previous reports, we have treated Central, Northern & Western Europe and Eastern Europe as separate regions. For this year’s analysis, we’ve reorganized our regional classifications to better reflect both current crypto activity and geopolitical realities. The data are now categorized into three main groups: The European Economic Area (EEA), which includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Iceland, Liechtenstein, Norway; Rest of Europe; and Russia and the UK (analyzed separately due to their significantly larger crypto activity volumes). This new structure provides a more accurate representation of crypto market activity while accounting for the region’s distinct regulatory and geopolitical landscapes.

Between July 2023 and June 2025, the European region demonstrated remarkable growth and resilience. Transaction volumes followed a distinctive pattern: after experiencing a decline in mid-to-late 2024, the market staged a robust recovery, reaching a peak of $234 million in December. This momentum carried into early 2025 and the overall performance underscores Europe’s position as a mature crypto market, characterized by strong institutional presence and widespread retail adoption across its diverse member states.

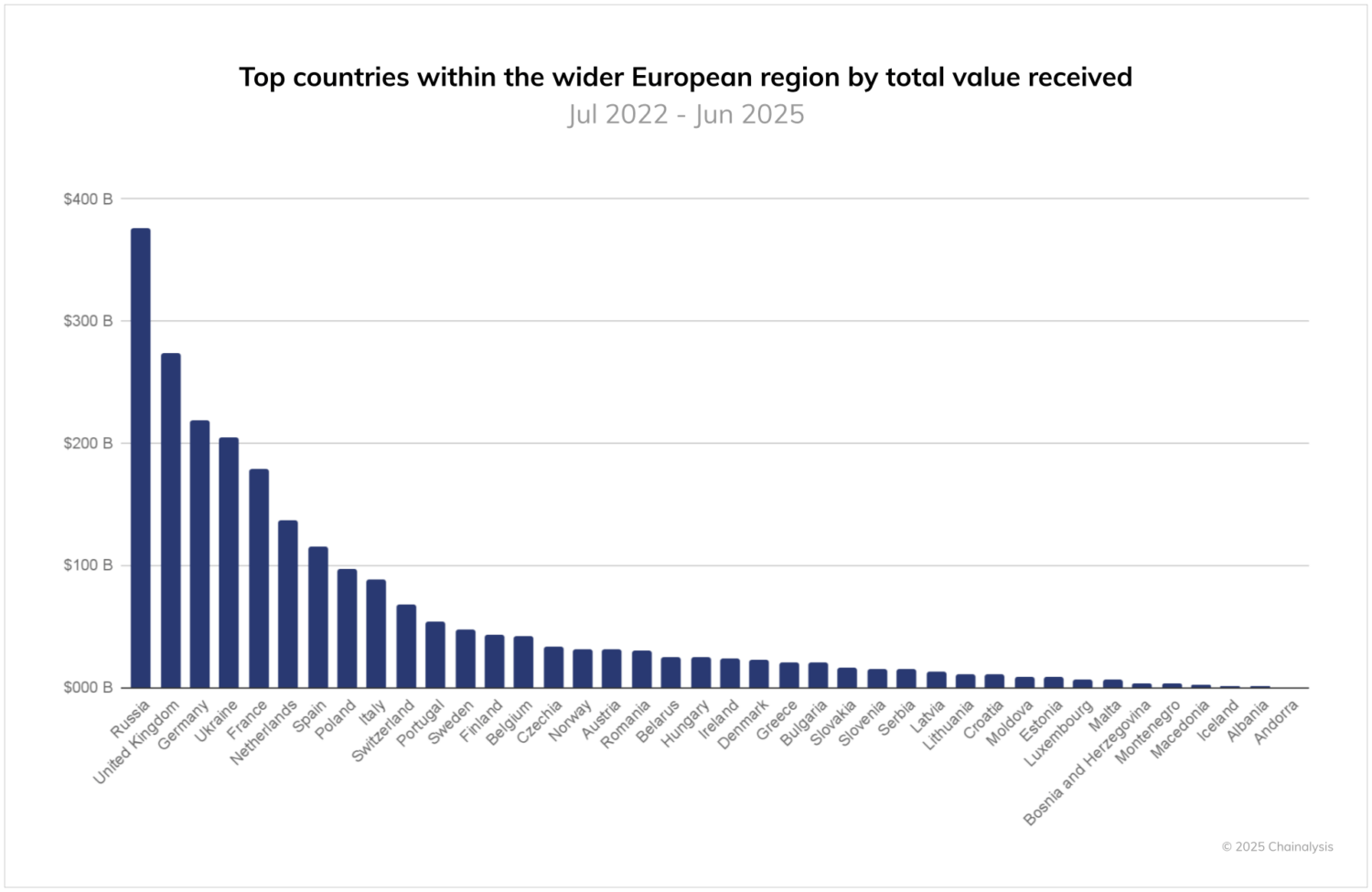

The top 10 markets span all corners of Europe, demonstrating broad-based adoption across the region. Between July 2024 and June 2025, Russia emerged as the dominant crypto market with $376.3 billion received, substantially ahead of the United Kingdom ($273.2 billion). This gap between Russia and the UK — traditionally the region’s leading markets — is notably larger than in previous years. Meanwhile, the difference in volume between the UK and other major markets such as Germany ($219.4 billion), Ukraine ($206.3 billion), and France ($180.1 billion) has narrowed significantly, indicating that previously smaller markets are now achieving comparable levels of crypto activity.

European markets show strong network effects

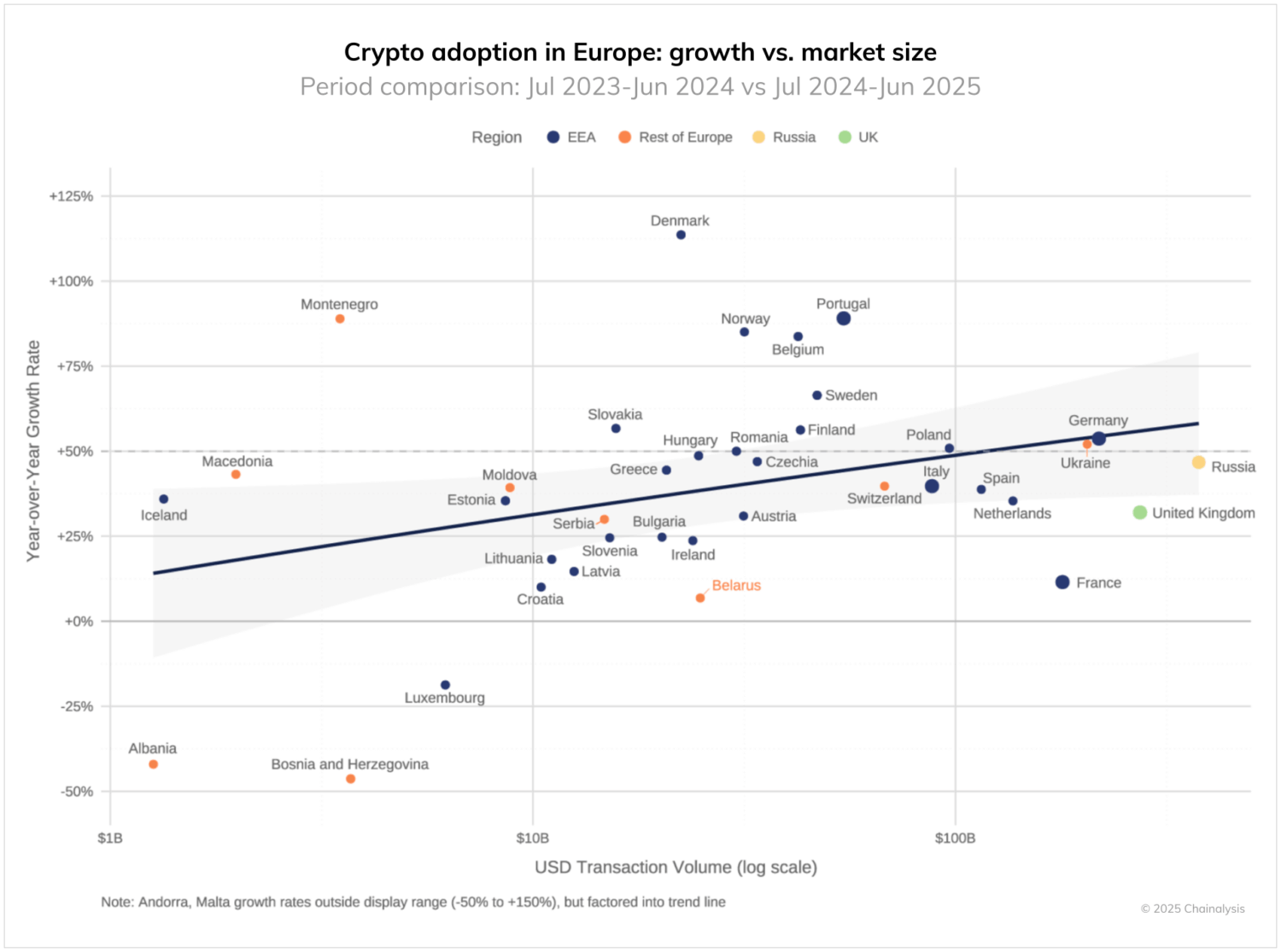

Growth patterns across the wider European area reveal a distinct relationship between market scale and growth rates, with country-level expansion driven by unique national factors within broader regulatory frameworks. Several large crypto economies stand out. Germany’s 54% growth reflects its emergence as a preferred destination for crypto-native firms, seemingly attracted by its established financial infrastructure and smooth implementation of MiCA regulations. Similarly significant are Ukraine (52%) and Poland (51%), where grassroots adoption and remittance flows continue to fuel market expansion.

Notably, the region exhibits an unexpected positive correlation between transaction volume and growth rates, challenging the conventional wisdom that larger markets grow more slowly. This pattern suggests powerful network effects in crypto adoption: as markets expand, they become increasingly attractive to new participants, creating a self-reinforcing growth cycle.

The trend aligns with classic S-curve adoption dynamics, where mature markets like Germany and Russia maintain strong momentum rather than plateauing. This sustained growth in established markets indicates that larger cryptocurrency ecosystems benefit from enhanced liquidity, institutional participation, and mainstream acceptance. The data suggest that European crypto adoption remains in its acceleration phase (in the upswing of the S), with network effects driving continued expansion, even in the most developed markets.

MiCA transforms the European crypto landscape

Now approximately ten months into implementation, MiCA marks Europe’s shift from a fragmented, AML-focused approach to the world’s first unified crypto framework. By harmonizing rules across the EEA, MiCA aims to promote market integrity, financial stability, and consumer protection while creating a level playing field across the region.

However, the reality of implementation reveals a more complex picture. Many jurisdictions maintain transitional periods allowing firms to operate without MiCA licenses until 2026, while others have yet to fully implement the regulation, creating gaps in the framework. Yet despite these challenges, MiCA has catalyzed a broader transformation in digital asset engagement. Previously hesitant traditional financial institutions are now actively exploring the space, with many offering custody and trading services. This institutional adoption spans multiple sectors, from major banks launching digital asset services to payment providers integrating crypto solutions, signaling a maturing market driven by clearer regulatory guidelines.

The rise of EUR local stablecoins

MiCA has fundamentally reshaped Europe’s stablecoin landscape. The European Securities and Markets Authority (ESMA)’s interim register now lists 15 e-money token issuers managing 25 distinct single-currency stablecoins. Notably, asset-referenced tokens backed by multiple reserve assets remain absent, though this may represent a future innovation frontier.

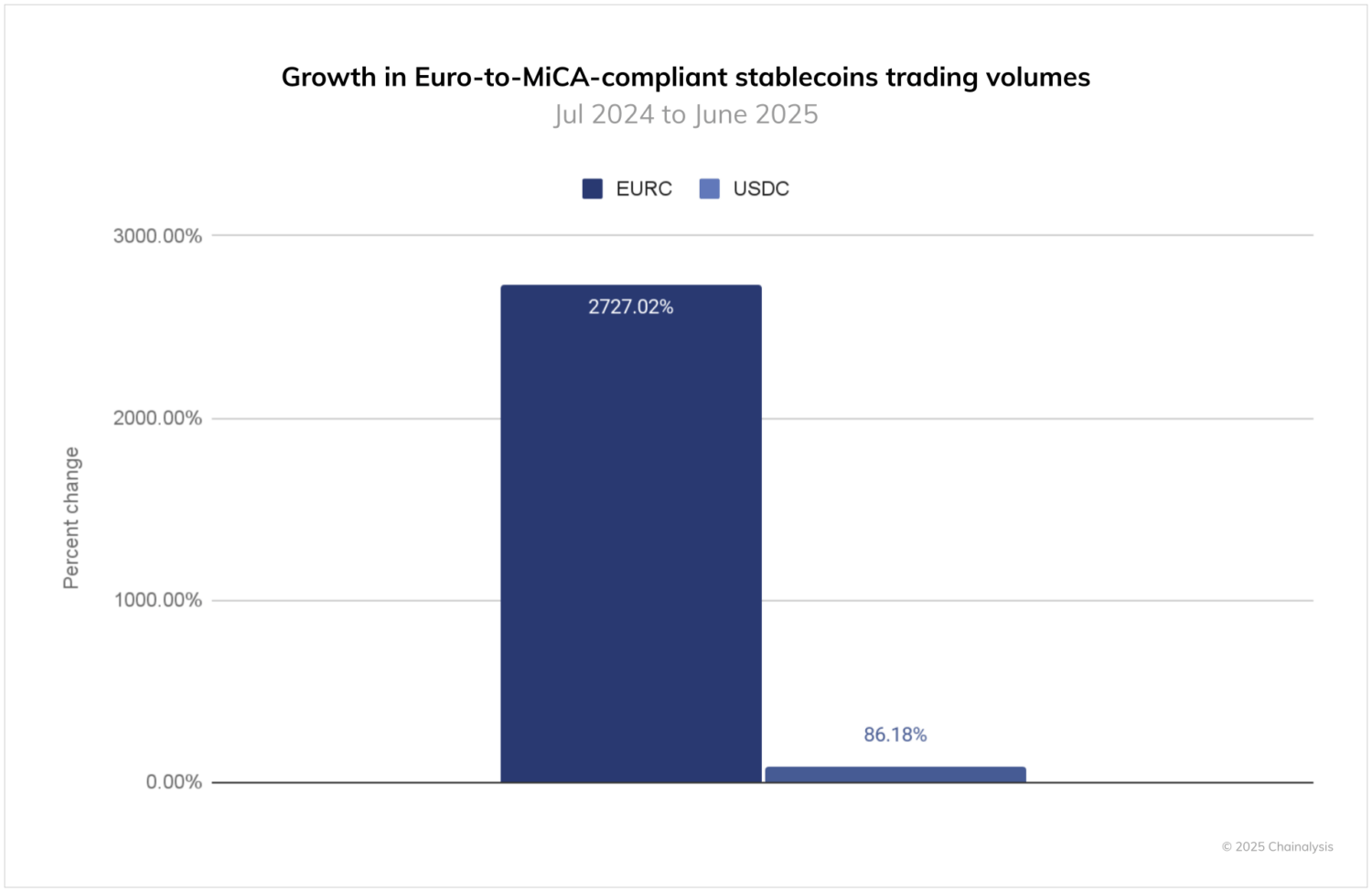

By restricting CASPs to MiCA-compliant stablecoins, the framework effectively excluded market leader USDT and triggered a significant market recalibration. Circle’s EURC exemplifies this transformation, achieving 2,727% growth between July 2024 and June 2025, far outpacing USDC’s 86% growth during the same period. This dramatic expansion, though from a modest base, demonstrates the potential of regulatory-aligned, local stablecoins.

USDC’s more modest performance largely reflects volume contraction as EURC gained prominence. This shift reveals the complex interplay of regulatory frameworks, market dynamics, and geopolitics shaping Europe’s digital asset landscape.

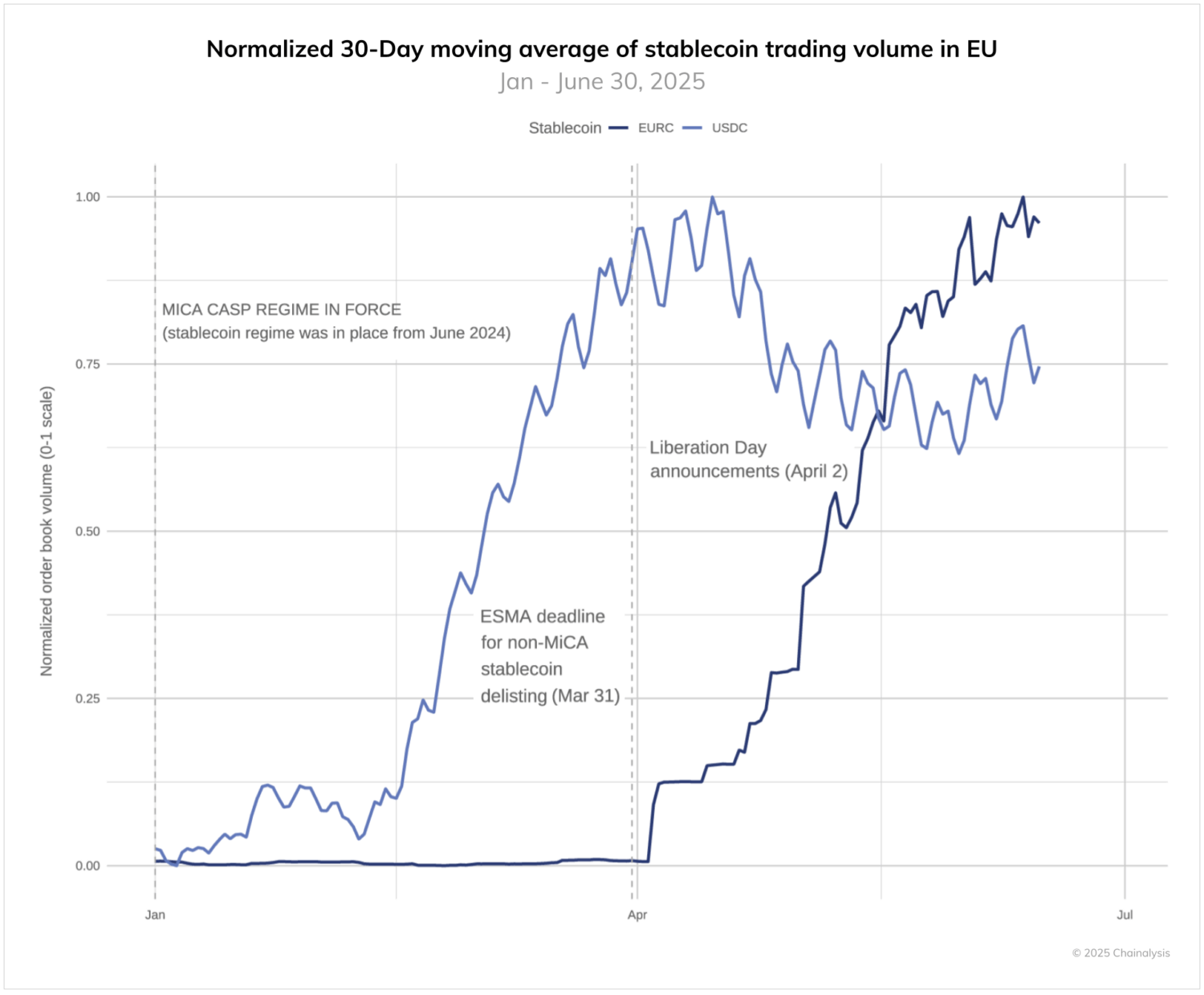

The following key milestones marked this transformation:

- December 2024 (MiCA implementation): USDC volumes surged as CASPs aligned with regulatory requirements, shifting liquidity from non-compliant tokens like USDT.

- March 2025 (ESMA deadline): USDC volumes stabilized, indicating completion of compliance-driven restructuring.

- April 2025: EURC volumes spiked while USD stablecoin demand declined, marking a strategic shift from USD to EUR-denominated stablecoins, influenced by both regulatory changes and geopolitical developments including U.S. tariff policy changes.

DeFi activity patterns across Europe

Decentralized finance (DeFi) activity in Europe continues to evolve, with discussions ongoing about potential regulatory frameworks to address emerging services such as staking and lending. Current analysis indicates DeFi activity remains a small but growing segment of the overall crypto ecosystem.

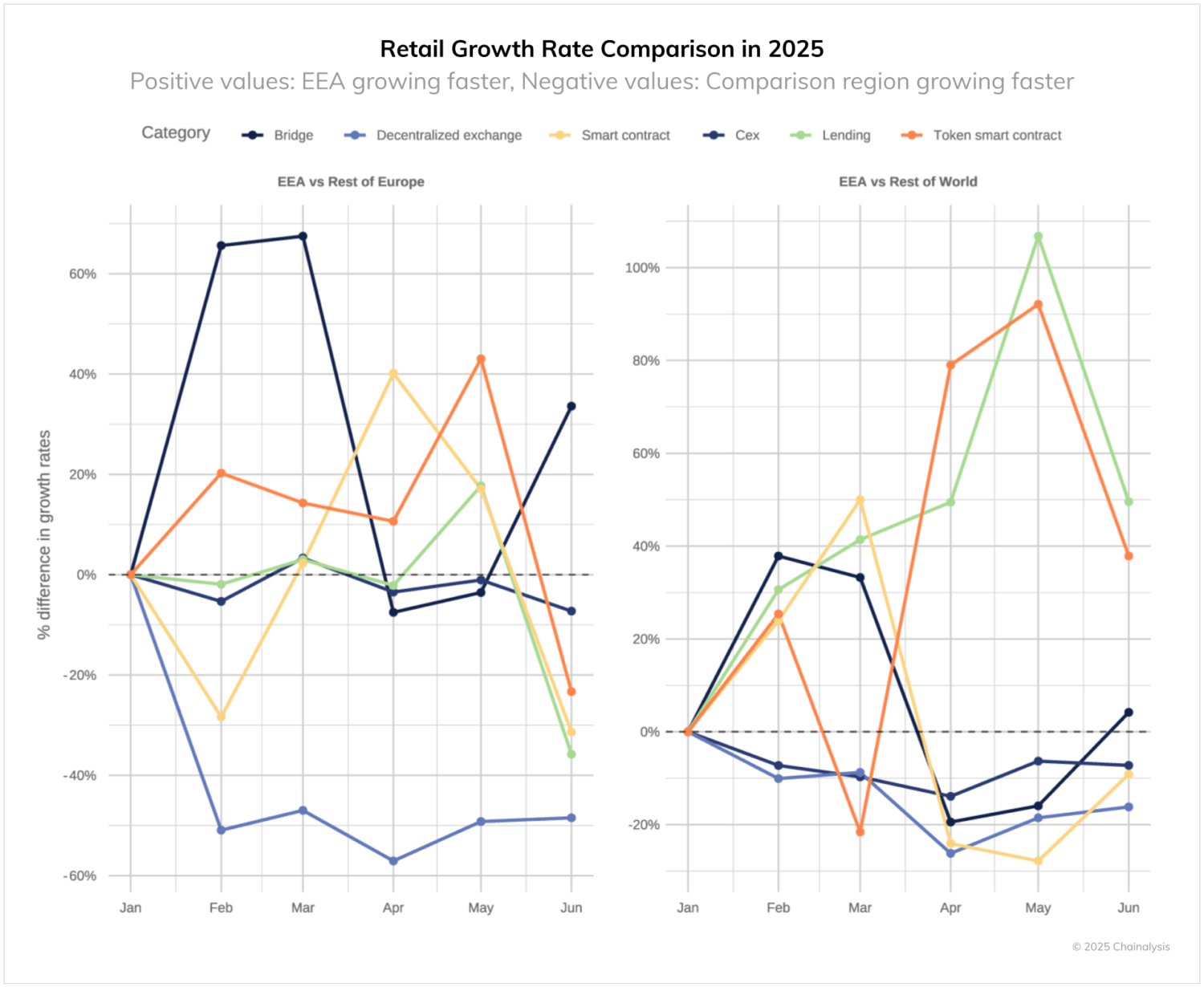

Comparing transactional patterns between EEA and non-EEA markets from January 1, 2025, reveals distinct regional characteristics across different transaction categories. The “bridge” category — transactions moving assets across blockchains — shows notable patterns in EEA countries. February and March recorded 65% higher activity compared to non-EEA European regions, correlating with the period of stablecoin market adjustments and increased cross-chain operations, particularly on networks like Binance Smart Chain and Polygon.

Decentralized exchange (DEX) transaction volumes in the EEA show different patterns when compared to other regions, particularly the rest of Europe. This variance primarily reflects increased DEX activity in non-EEA regions, especially Russia, rather than indicating any structural differences in the EEA market.

The EEA shows distinctive performance in two categories: “token smart contracts” and “lending.” Token contract activity, including minting and burning of digital assets, increased during the regulatory transition period. Lending activity reached its peak in May 2025, reflecting users’ engagement with various DeFi services for lending and borrowing against crypto assets.

Is UK activity faltering or transforming?

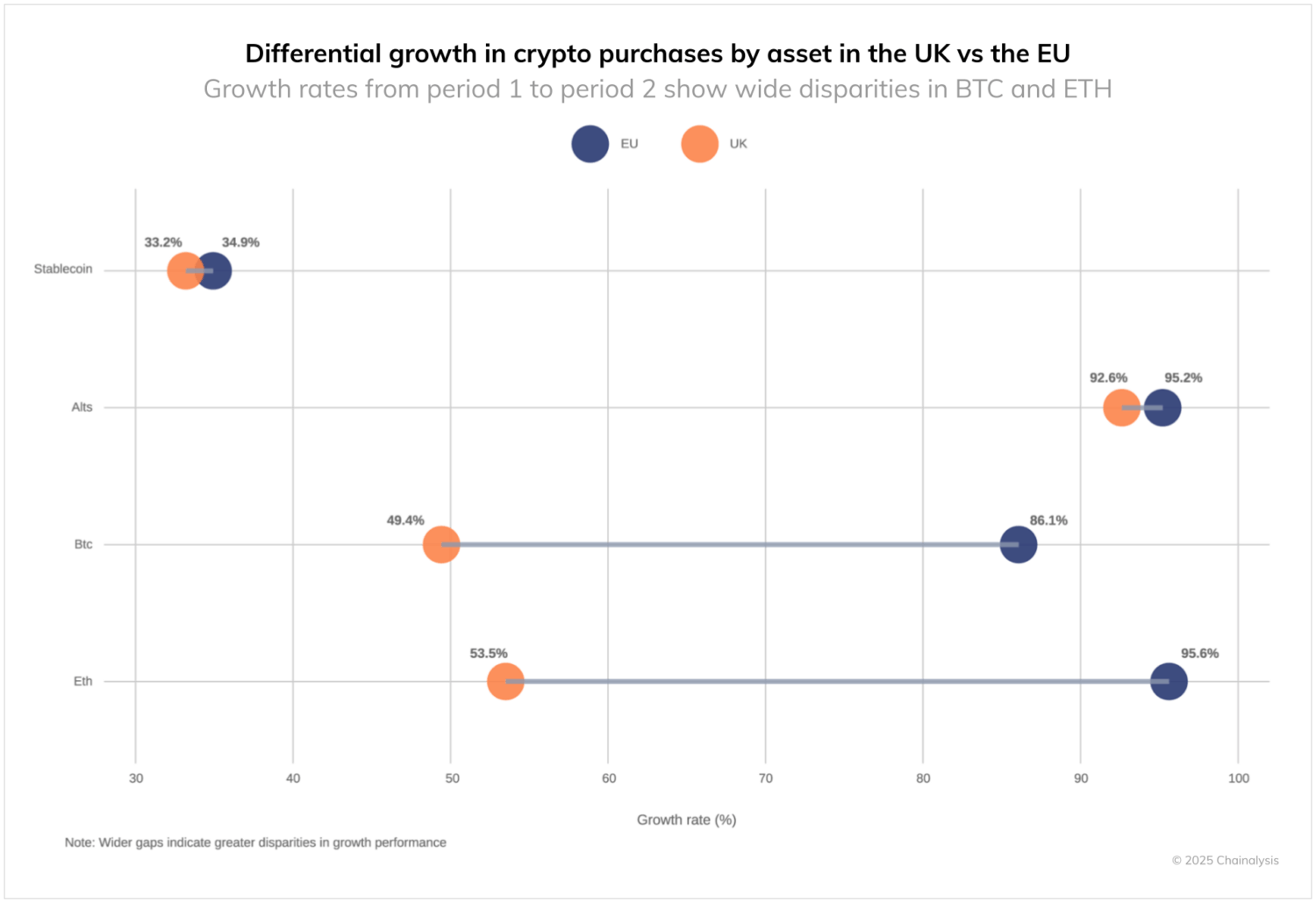

While the United Kingdom has ceded its regional top spot to Russia, it maintains a robust and diverse crypto market, demonstrating 32% growth over the last year. However, the data reveal shifting patterns in trading activity compared to its European neighbors. Asset-level analysis of UK purchasing on centralized exchanges shows stablecoin and altcoin activity matching EU-denominated volumes, while BTC and ETH purchases have been notably more subdued.

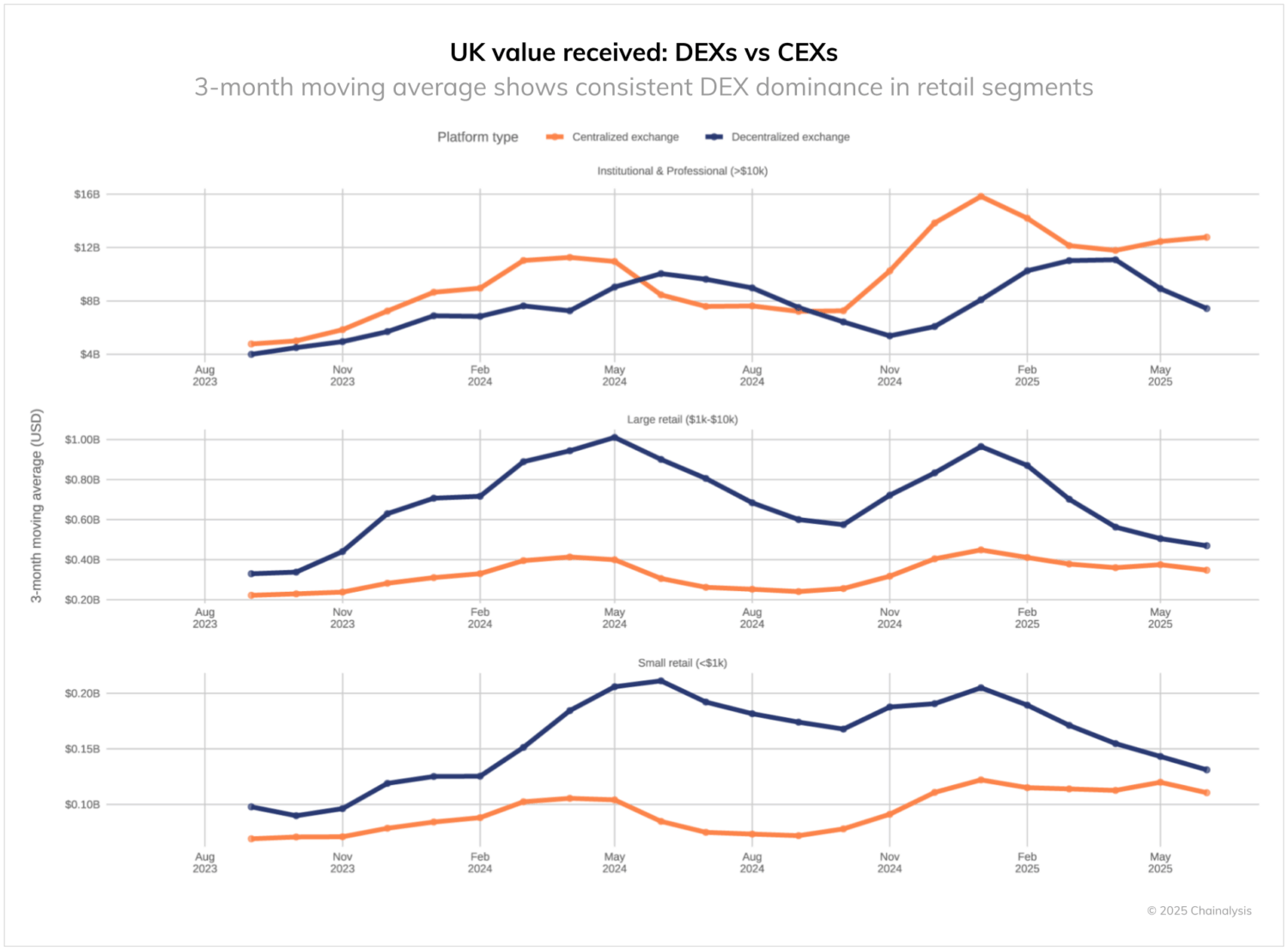

Despite reduced BTC and ETH activity, sustained engagement with altcoins suggests a maturing market. This pattern typically indicates increased DEX utilization, as users engage in activities like staking and lending — functions that often require altcoins more readily available on DEX platforms than centralized exchanges.Our data confirm this trend: retail-to-DEX flows consistently exceed retail-to-CEX flows, a pattern observed since August 2023. This shift aligns with the UK’s cautious approach to retail crypto access, beginning with the 2019 ban on retail crypto exchange traded notes (ETNs) and extending to the January 2024 implementation of consumer protection rules. These regulatory measures, primarily affecting centralized exchanges while leaving decentralized services relatively untouched, may have influenced retail traders’ preference for DEXs.

The institutional landscape presents a contrasting picture, with centralized exchanges remaining the preferred venue for larger trades. This institutional engagement represents a key strength in the UK ecosystem, particularly as new initiatives take shape. The Wholesale Financial Markets Digital Strategy and Digital Securities sandbox could position the UK as a hub for institutional crypto clearing, settlement, and broader financial engagement.

In essence, the UK crypto market isn’t contracting but rather evolving: retail traders increasingly favor DeFi platforms while institutional players maintain their preference for centralized venues, suggesting a market adapting to both regulatory changes and expanding opportunities.

Russia’s expansion into DeFi

Russia has emerged as the region’s leading crypto market, with received volume reaching $379.3 billion, a substantial increase from last year’s $256.5 billion. This dramatic growth stems from two key trends: a surge in institutional-scale transfers and accelerating DeFi adoption.

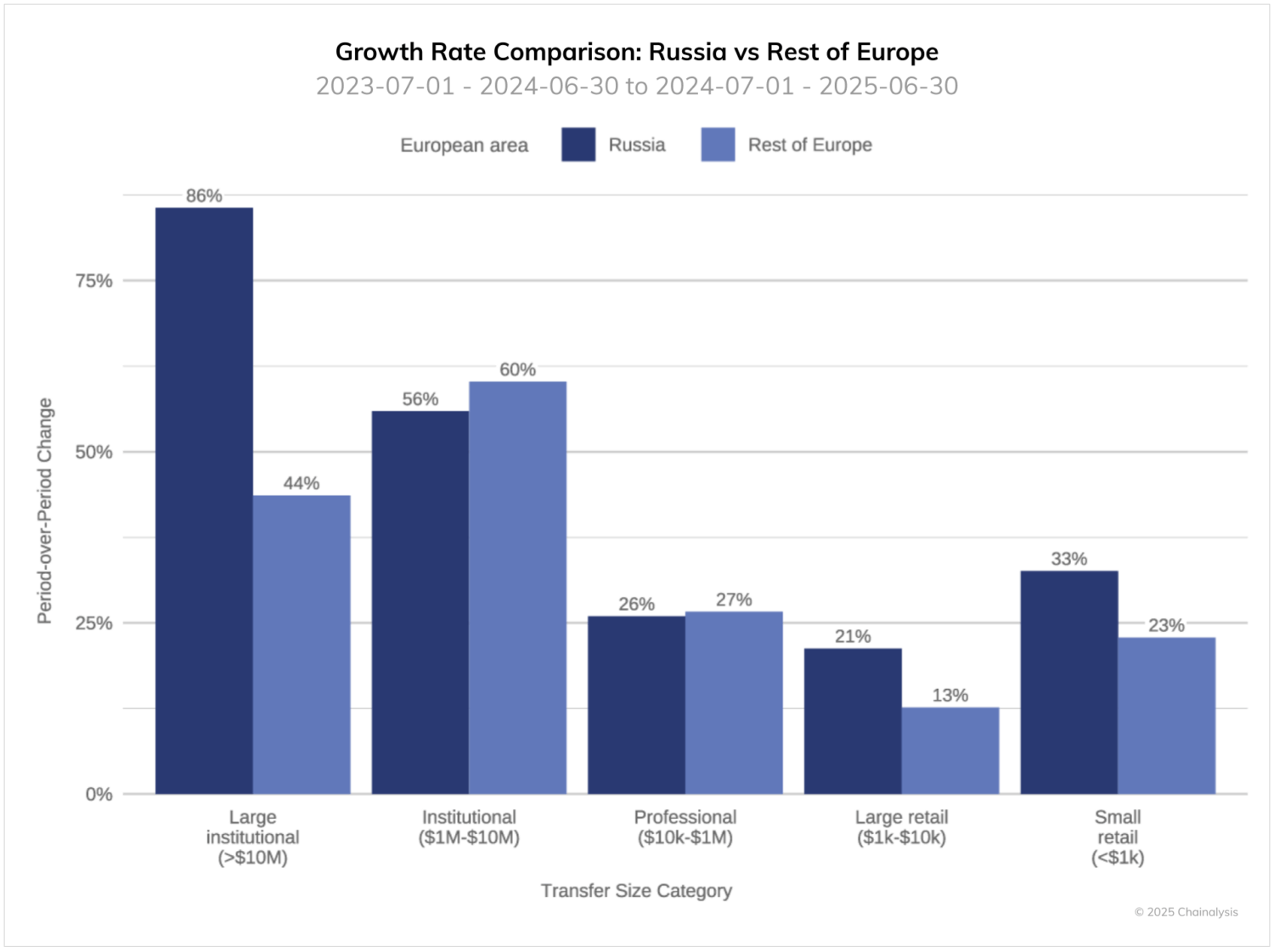

The scale of institutional activity is particularly notable. Large transfers (exceeding $10 million) grew by 86% period-over-period, nearly double the 44% growth observed in the rest of Europe. Meanwhile, other segments of Russia’s crypto ecosystem, particularly small retail activity, showed growth rates moderately exceeding European averages.

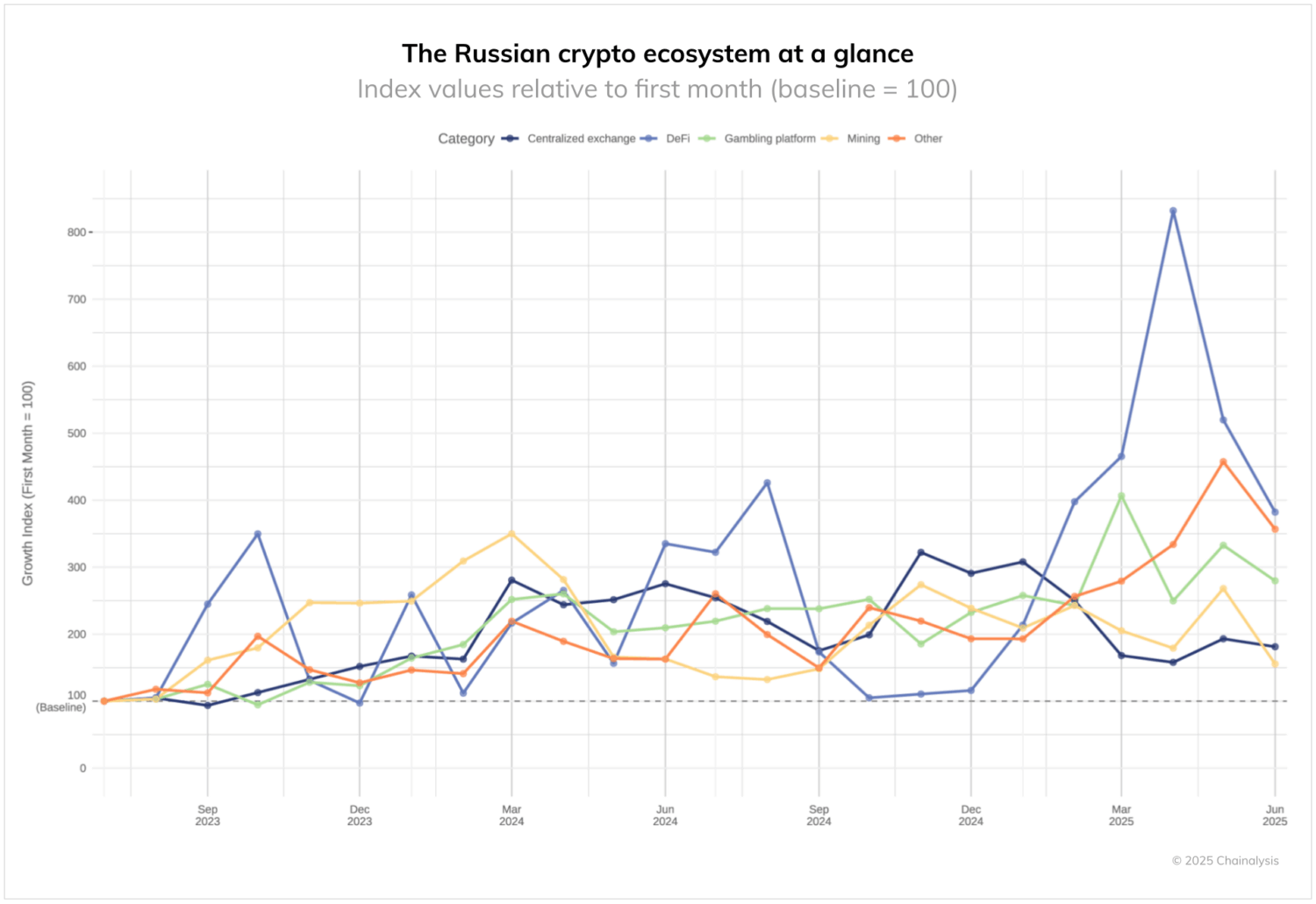

DeFi adoption patterns reveal an even more dramatic shift. Early 2025 saw DeFi activity surge to eight times its previous levels, eventually stabilizing at roughly three and a half times the mid-2023 baseline. This rapid DeFi expansion, coupled with the increase in large-value transfers, indicates growing adoption of crypto for financial services. The A7A5 ruble stablecoin exemplifies this trend, facilitating cross-border payments for both institutional and business users.

Looking ahead: Europe’s evolving crypto landscape

The European crypto landscape of 2024-25 reflects a market in sophisticated transition, shaped by regulatory frameworks like MiCA, evolving institutional engagement, and growing DeFi adoption. While traditional financial hubs maintain their significance, new patterns have emerged: Russia’s surge in large-value transfers, the UK’s shift toward DeFi platforms at the expense of CeFi, and the EEA’s adaptation to regulatory requirements through new stablecoin solutions.

These developments, combined with the unexpected correlation between market size and growth rates, suggest that European crypto adoption remains dynamic and resilient, with network effects driving continued expansion even in the most mature markets. As the region moves forward, this interplay of regulation, innovation, and market forces continues to reshape Europe’s position in the global crypto ecosystem.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.